Student education loans in the united states already complete$step one.73 trillion so if you’re some of those with debt, you know it could be a giant weight to the students simply entering the workforce. (As well as those who have come employed by years!)

For folks who haven’t arrived job just like the graduating, thankfully as possible sign up for deferment, and you also won’t accrue a lot more desire costs at that moment. If you find yourself fresh to the latest associates and you can making little or no, you can make an application for an income-situated cost (IDR) bundle, which takes your earnings under consideration to determine monthly premiums (notice, during the time of writing IDR arrangements have been influenced by a national court case. Info, here.)

Of these rather than those individuals choice, there is certainly nevertheless guarantee. But how, just, are you currently supposed to pay-off the debt when you’re rarely dealing with to help keep your head above-water? Very first, be aware that you aren’t by yourself. Next, here are a couple steps you could potentially implement to be certain you are making your instalments promptly, plus one go out in the near future, as personal debt-100 % free.

step 1. Carry out A budget You can Stick with

A good budget is essential if you want to keep financial concerns straight. (For those who have not tested our podcast having YNAB Founder Jesse Mecham toward Cost management Instead of Tears it’s a must-pay attention, as is the story on precisely how to budget in case the paying habits have altered!) There are countless an easy way to finances, and another of your favourite measures is the budget. Its rather simple to follow along with, and very pupil-amicable. Which funds implies that your allocate fifty% of one’s money in order to things you need, like lease or other monthly expenditures, 30% so you’re able to stuff you wanted that aren’t necessary to the emergency, and 20% into discounts and you will debt repayment. Once you get started, you will be astonished just how merely keeping an eye on their expenses can transform your financial lives.

2. Make use of your Gift suggestions Intelligently

As soon as you receive money for the birthday, a vacation, graduation or some other celebration, it might be appealing to treat you to ultimately a product or service (otherwise several situations!) in your wishlist. However, provide certain think very first. Do you really need you to situation you’ve been eyeing? Just how much better would you getting for individuals who set those funds on are obligations-100 % free?

Consider carefully your current just like the bonus money. Anyway, your just weren’t counting on it part of your financial allowance, so why not place it to your coming? I bet the one who provided you you to definitely generous present carry out probably be very happy to know that you’re with the currency to change debt condition, and reach your large existence needs. Plus the faster you have to pay down their fund, the higher out-of you are. For people who simply make minimum commission every month, it might take you to 20 or even 30 years to repay your loan completely. You deserve to reside your absolute best existence, debt-100 % free. Why not lead more money to making you to happens?

step 3. Build Autopay

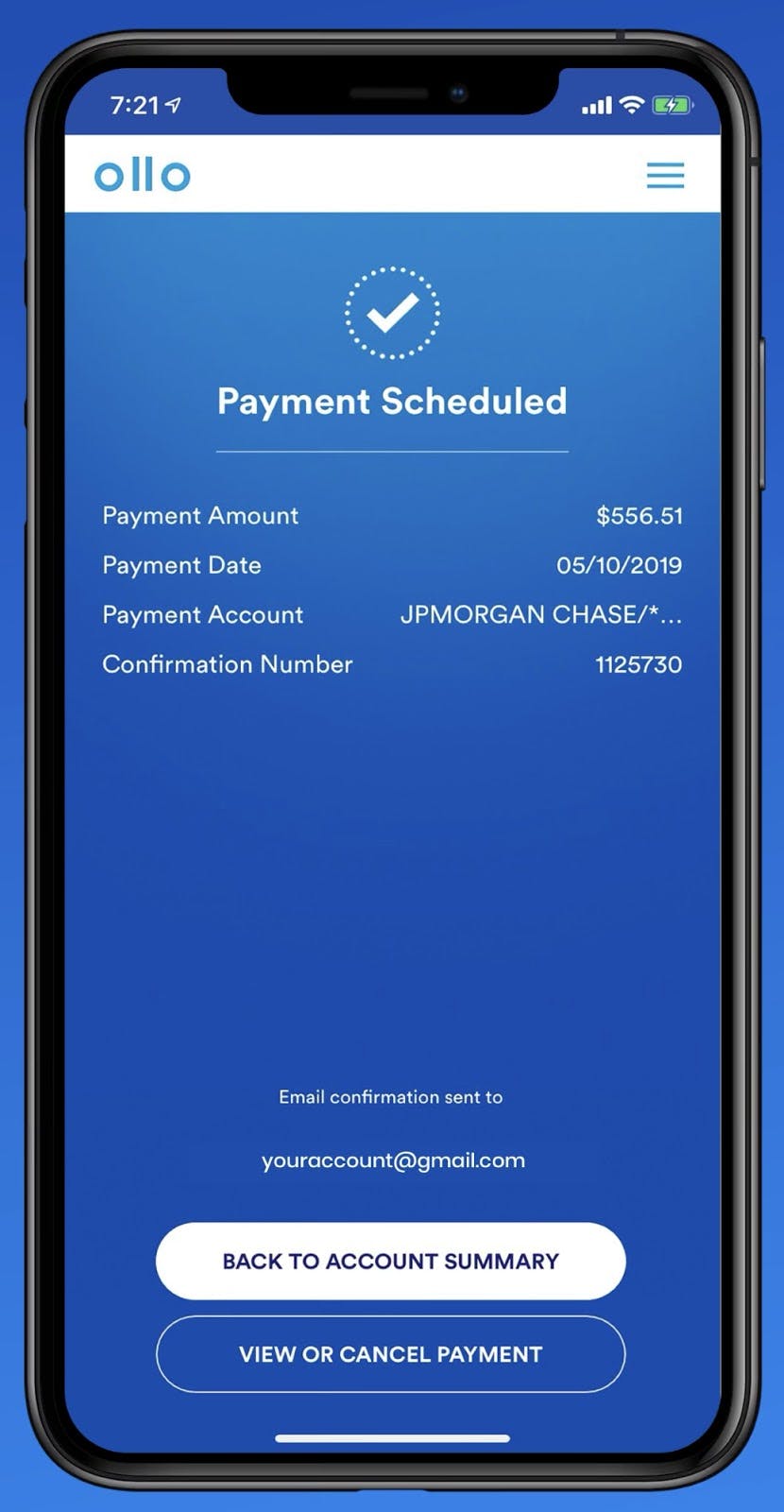

When you create autopay to suit your education loan costs, the payment was immediately deducted from your family savings, while never miss a cost since the it’s all going on immediately. Autopay and allows you about how to create bi-per week payments. That one might Alaska installment loans be high quality for people who get paid every two weeks. The theory is always to make money most of the 14 days by the busting your own normal payment per month in two, and by the termination of the entire year, you wind up paying a great deal more for the the debt than simply might has actually with a vintage payment, since the several months provides four months. And you will, bonus: spending towards the your debts each month, timely, also has actually your credit rating right up.

4. Like Your job Carefully

It’s really no wonders one to some work offer higher salaries than the others. For example, an engineer is probably planning make more money right away of college or university than simply some one regarding the hospitality industry. If you are looking to earn doing you might early in your job, and you’re passionate about many different anything, then you might want to purchase the field highway in which you might earn the best salary. Including, keep in mind that specific careers secure get secure professionals (along with forgiveness) regarding federal loans. Somebody performing operate about social markets, such as for instance teachers and you can nurses, could be entitled to sign up for mortgage forgiveness. Just be sure you investigate terms and conditions! And remember to spend attention with the benefits you’re considering before you could accept a special occupations. Select a position having health gains, pensions, so when you’ll be able to, advice about scholar loans payment.

5. Check out Refinancing

Possibly, the best way to pay financial obligation should be to redistribute it to a different bank which have down appeal. If you re-finance the financing, the debt will be presented to a private lender. Fortunately that finance commonly all be lumped also you to definitely lender, potentially with a lower life expectancy interest. Only like cautiously, since you could end with mortgage loan you didn’t allowed and you may incorporate time for you your debts.

Whenever you are shopping for refinancing, you can easily potentially earn several benefits. A diminished interest function you can pay-off your debt eventually – protecting years on your beginner financial obligation cost plan .

Since the another option, you could find for people who qualify for an effective probate advance, you’ll find if you stand-to inherit at the least $ten,000 from a close relative a while later. Credit up against the inheritance is preferable to borrowing out of a keen additional bank, as funds will be your very own to start with – but, however, it is not a choice for visitors.

The Diligence Pays Out of

The typical Western college student deal $forty,681 in the education loan personal debt. That’s a formidable share which could very well be an equivalent number because someone’s very first-seasons income out-of college. It’s no wonder it may end up being daunting to try out most of the immediately. The good news is, with the methods, you could make beginner personal debt installment smoother – and get financial obligation-free sooner than your thought.

Recent Comments