- Refinance or reprice the real estate loan to attain deals however, create an installment-work with study very first.

- Imagine and make a much bigger down-payment in advance to minimize instalment count and you will spend less on overall focus payable.

- Mortgage insurance coverage will come in useful in case of brand new insured’s dying, critical problems otherwise long lasting impairment.

Dealing with your own mortgage loan payments can be hard throughout a monetary setback or when times are difficult. Value is vital having big-violation orders such as a home because it’s apt to be their prominent monthly bills.

Yet, staying a threshold more than their family members’ head is actually a switch concern. Having wise financial believe when buying a house, it is possible to keep your mortgage payments reasonable.

Which have a backup plan will help make sure home ownership is an activity you really can afford actually during the hard financial points. This includes that have a beneficial stash regarding emergency deals that you can be mark on and you can automating a predetermined amount to a savings membership to be used to own home loan. Let us read the various ways to build your real estate loan inexpensive:

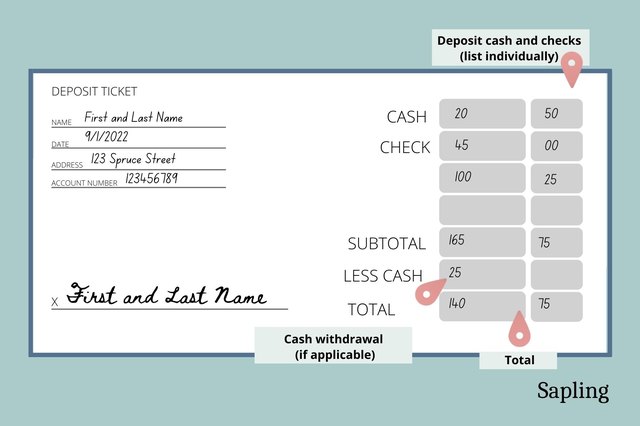

step 1. While making a much bigger down-payment

If you find yourself to find a home, carry out believe and also make a much bigger downpayment up front once the it will help to minimize the appeal will set you back payable over the borrowed funds period. You’ll also benefit from down monthly installments. Yet not, manage be sure to have enough emergency loans prior to the down percentage.

dos. Make use of your windfalls and come up with limited money

Make use of your windfalls such as annual bonuses and come up with partial repayments on your own lenders. This will lower your a fantastic principal and you can desire costs. Before you could accomplish that, be sure it is possible to make partial costs without having any punishment.

3. Playing with CPF fund unlike bucks

To simply help financing their month-to-month homeloan payment, thought using your CPF financing instead of dollars when you yourself have a tight income disease. not, just before scraping on the CPF fund, create ensure that the amount on your CPF Normal Account try enough to pay the month-to-month mortgage loan instalment as it may become limited as well.

When your economic health improves, imagine changing to having fun with bucks to spend the mortgage instalments, unless of course their assets can also be make greatest returns than the CPF OA at 2.5% p.a beneficial.

cuatro. Refinance otherwise Repricing your residence financing

- Refinancing – Move your own HDB financial during the 2.6% per annum to help you a mortgage which could provide a lowered interest rate. In addition, it setting you might key you to definitely mortgage to another bank loan to reach discounts.

- Repricing – Option your current home loan bundle to another bundle regarding the same financial. The best thing about repricing is some banking companies bring a-one-go out repricing give in order to change to another type of bundle having 100 % free. However, create keep in mind that not every banks bring one to thus excite evaluate before switching.

The method would-be a lot faster, to prevent less records and might manage to end incurring charges. One of fast cash loans Russellville AL these out-of a home loan ‘s the DBS HDB loan which allows one take pleasure in better coupons, stop personal accident and you may sudden death of earnings and additional appeal made.

Why don’t we for example take, Andy whom recently turned his CPF financial to help you a good DBS mortgage which comes in the a predetermined rates of just one.4% p.a for good 5-12 months months.

Remember to choose intelligently by weighing the huge benefits and disadvantages of your house loan prior to refinancing or repricing. Spend some time to think of whether or not a fixed or varying speed loan would match your objective. Ensure that you is actually financial support to lower their interest rate and not to boost the interest.

If you were to button away from a HDB financial to help you a bank loan, it might be impractical to button back into a good HDB domestic mortgage should you have one second thoughts in the future, therefore allow yourself a little while to consider it.

On top of that, by firmly taking financing regarding HDB, there won’t have one early redemption fines. Yet not, the fresh costs linked to a mortgage create range between bank to help you lender, so it is important to check if the potential desire offers are higher than brand new switching can cost you.

Be cautious about possible will set you back from your the latest home loan also, such as for instance court costs billed of the financial. On the other hand, specific banks give dollars rebates so you’re able to offset the courtroom and you will valuation charge working in refinancing.

#3 Get a hold of an appropriate loan package that fits their risk threshold, affordability and you may financial considered desires assess your position basic rather than opting for the cheapest alternatives immediately.

Sooner or later, they relates to that which you actually need very always keep in mind to understand your aims. After that you can generate a knowledgeable decision and filter out choices that don’t match you.

5. Downsize to a smaller family

Offer and you may downgrade in order to an inferior household in order to features shorter if any financial to pay when compared with your own early in the day flat.

six. Leasing out room and/or whole home

Renting out element of your home if you have the most space, can assist a great deal in generating extra money. However, if it comes to the right position in which some thing get tough, you can attempt moving in along with your parents and renting out all of your current house, to produce high rental earnings.

eight. To get mortgage insurance

Home loan insurance rates offers a lump sum payment of cash to pay off the new an excellent mortgage in case there is new insured’s dying, critical problems or permanent handicap.

When you find yourself maintenance home financing, you will need to purchase one whilst handles the ones you love in case of an emergency, such as your unexpected passing. When that occurs, it might bring about your family members overpowering the duty from paying the left financial, ultimately causing a supplementary financial burden from their store.

Identical to the manner in which you individual medical insurance to fund you and your family facing aside-of-wallet hospital costs, providing mortgage insurance usually cover your loved ones away from dropping the newest rooftop over their thoughts.

8. Fool around with a digital financial product

End up being economically sensible and make certain you have enough bucks to expend for the expenses month-to-month to prevent taking on a hill off costs.

The new DBS Bundle & Invest case inside digibank was a helpful electronic financial considered and you will retirement advisory equipment which can help you to categorise other expenses and you may arrange for your financial fitness, including accumulating significantly more to settle the financial, relative to your goals.

Start Believe Today

Check out DBS MyHome to sort out the new amounts and acquire a house that fits your financial budget and you can choice. The good thing it slices out of the guesswork.

Alternatively, ready yourself having an out in-Principle Recognition (IPA), you have certainty on how far you could acquire to possess your residence, allowing you to know your finances precisely.

Recent Comments