Obtaining good HELOC during senior years makes it possible for you to definitely shell out for some big expenses. You ought to have at the least some equity of your home to adopt this 1. Even if you have a mortgage, a good HELOC can work to you providing you create the payments to your advancing years funds. It is critical to create typical repayments towards the a good HELOC to be certain that you will have entry to it once more when you need they.

A house guarantee personal line of credit (HELOC) allows a borrower to draw toward a credit line more than a specified few years in the a varying otherwise fixed rate interesting. The lender tend to identify the maximum amount as you are able to use. The latest security in your home ‘s the security having good HELOC, exactly as its having a house guarantee loan/2nd financial. Residents generally use HELOCs to pay for big repeating costs including since the scientific expense and renovations rather than getting every single day costs.

The Shape Household Equity Line are a HELOC that actually works an effective portion in different ways away from a vintage HELOC. The ensuing list reveals four reason why older people who own the very own residential property like HELOCs.

1. Healthcare

HELOCs are useful for purchasing medical costs, as the specific positives vary based on health and wellbeing and relationship condition. Investing in Older Proper care account you to definitely older people exactly who get a good HELOC don’t need to are now living in their home, thus a good HELOC would be recommended for the elderly exactly who need care and attention external their homes. The choice to transfer to elder property commonly leads to a selection of swinging expenses. Good HELOC can help you protection people lingering can cost you until you could potentially pay for enough time-title care, possibly through the sale of your property.

dos. Domestic instructions and solutions

A lot of people intend to move four in order to a decade immediately following old age, with respect to the Equilibrium. They would like to move nearer to grandchildren or perhaps to a beneficial weather. Possibly older people would like to real time near anybody her many years. No matter what cause of swinging, they usually pertains to to find an alternate family in advance of attempting to sell the old one to. Seniors are able to use a HELOC to fund new advance payment toward the new family because of the borrowing facing the guarantee in the modern home. This tactic is oftentimes a lot better than liquidating expenditures, and this runs into trading will cost you and you will income tax debts.

Someone commonly neglect to consider the price of home repairs whenever thought the advancing years, but such as expenditures is eliminate a spending plan. A home will surely require big repairs just after 20 in order to 30 years, that will exist out of the blue. Drawing with the an effective HELOC provides a substitute for liquidating property for example while the opportunities or old-age profile. Credit funds thru an effective HELOC allows you to repay the mortgage slowly as opposed to disrupting their collection.

step 3. Auto instructions

To find a vehicle every a decade or so is yet another debts that folks tend to forget when thought their old age funds. So it expense can be incur an income tax responsibility if your primary money is inside income tax-deferred levels such as for example IRAs and you can 401(k)s, due to the fact people matter your withdraw because of these levels might be sensed taxable money for that season.

This aspect off advancing years membership becomes a lot more out of a downside when a giant withdrawal such as an auto buy carry out push you towards a higher taxation class. Imagine for this analogy your regular withdrawals from your advancing years membership are taxed at a level from 15%, but that the most detachment having a vehicle pick do push your into 25% bracket. In this situation, it can be best to use an effective HELOC to cover the fresh new pick. You could next repay the loan gradually, steering clear of the highest taxes that would be due to and work out an effective higher withdrawal off a retirement account in one seasons.

4. Solution source of cash

Controlling your finances while in the retirement is pretty distinctive from controlling their things if you find yourself working. When you find yourself getting income, you could potentially endure a downturn in the business of the temporarily boosting your financial investments in order to reconstruct the profile. However, a down market has a unfavorable impression once you retire and start to make normal withdrawals from the collection, a disorder popularly known as succession chance.

A good HELOC can allow one prolong the life span regarding your earnings stream by detatching the profile withdrawals throughout the down age, maybe even removing the necessity for all of them completely. In this situation, you are having fun with an effective HELOC instead supply of dollars, which you can pay off from the profile after it recovers.

5. Improving the high school students

Adult children usually you need temporary financial assistance that they ultimately often have the ability to pay-off. Activities in which mature students need a short-term dollars increase from their parents are starting a corporate, to find a house and you will going right on through a time period of unemployment. Should one of your people ask you to definitely aid in this way, you might want to consider utilizing a good HELOC if the liquidating possessions usually incur a tax punishment. If you were to think you could potentially wanted usage of a supply of funds suddenly, you have to know getting good HELOC in advance of the desire.

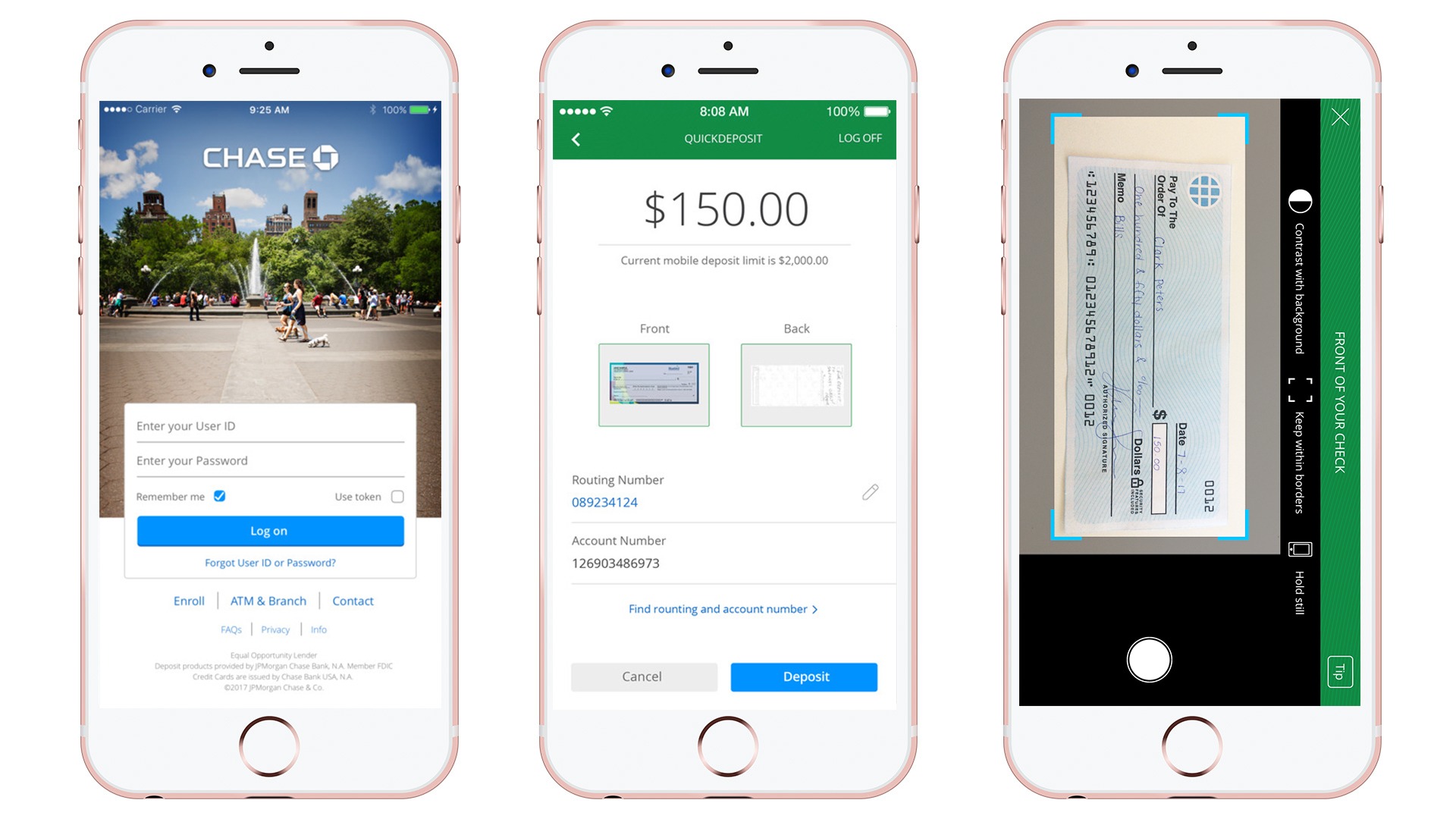

If you plan to utilize Figure’s HELOC, you must know that it is a little while unlike a classic financial HELOC. Firstly, our very own whole app techniques is online, in order to done an application in as little as four minutes. Once you have started approved, capital can happen inside the only 5 days step 1 navigates so you can designated disclaimer . Subsequently, our very own HELOC offers a fixed personal loans Tennessee interest dos navigates so you’re able to numbered disclaimer and you will lump sum payment if you are acknowledged. You should buy started with your currency instantly.

Summation

Trying to get a beneficial HELOC during senior years can allow you to definitely pay for many big expenditures. You should have no less than specific security of your house to look at this. Even if you continue to have home financing, a beneficial HELOC can work for your requirements if you generate the fresh new repayments in the old age finances. It is very important generate typical payments toward good HELOC to make certain you will have use of it once again when you require it.

Related posts

HELOC draw period is the time when you could withdraw funds from your home equity personal line of credit. Know how it really works within publication.

HELOC installment is the months when you pay-off the bill of your property guarantee line of credit. Learn the goals, the way it works, and the ways to take control of your repayments efficiently.

Shedding about for the HELOC payments may have big outcomes, and property foreclosure. Learn what direction to go if you’re unable to create repayments in your HELOC.

Recent Comments