When you tune in to the term refinancing, you may want to quickly remember mortgages and you can car loans. You could re-finance signature loans, as well.

Refinancing an unsecured loan are a beneficial solution which can all the way down monthly costs and help your probably pay reduced interest more than living of your own financing.

About what its so you’re able to whether it makes sense for you, i fall apart personal bank loan refinance here, and exactly what methods to take to really make it takes place.

What is refinancing a personal loan?

While it may seem difficult, refinancing a consumer loan only implies that you employ a new financing to repay your mortgage.

Borrowers typically accomplish that to attenuate monthly premiums due to a diminished interest or stretched fees several months. An additional benefit for the majority of is the option to score an effective huge financing to pay off the brand spanking new mortgage, up coming explore left funds with other some thing they require.

The borrowing has actually enhanced If you have increased your credit rating given that starting the old mortgage, you can be eligible for a lower life expectancy interest on the a unique mortgage.

You want a predetermined interest Relocating to a predetermined rates out-of a changeable rates will save you cash on notice, possibly reducing monthly obligations.

You want lower monthly premiums A diminished interest rate you’ll drop off monthly installments. Extending your own fees term can also be decrease your monthly premiums as well. (Recall, but not, one a longer loan title implies that you might spend way more altogether appeal along side longevity of the borrowed funds.)

You receive a better price Personal bank loan refinance can help you with the same lender otherwise another one. Research the better now offers from your newest financial plus new ones. If you find a package that works well most readily useful for your condition, do it.

Benefits associated with refinancing a personal loan

All the way down interest In the event your brand new loan even offers a lesser attract price, you might save on monthly obligations which means additional money on your pocket.

Less benefits Adjusting your loan title committed to pay off the loan can be an earn when you re-finance, particularly if you want to pay it back quicker. This could enhance your monthly premiums, but you’ll hit that sweet $0 harmony sooner or later.

Extended payment several months If you need more time to settle your loan, refinancing an unsecured loan is also offer your own installment period.

Fixed interest When your financing currently has an adjustable attention speed, a great refinance can provide the chance to change to good fixed rate. This might mean down monthly installments additionally the reassurance that is included with percentage balances.

Additional funds If you possibly could have fun with some extra money, you happen to be capable re-finance your very own loan which have an excellent large you to. After you pay-off your current mortgage, what is actually left are your own to use because you like.

Disadvantages regarding refinancing an unsecured loan

Additional charge Just before refinancing your very own loan, make sure you investigate small print throughout the potential charge you is energized. These could is both origination charge and you may prepayment charges to own purchasing of the loan very early.

Investing a great deal more attract over the years Stretching your repayments which have a lengthier identity may provide certain recovery when it comes to monthly payments, however it is almost certainly you can easily pay alot more focus over the longevity of the loan.

Lengthened loans It is important to understand that if for example the re-finance boasts a longer mortgage label, you are able to eventually wind up remaining in personal debt lengthened.

Procedures to help you re-finance an unsecured loan

Now that you know more about refinancing an unsecured loan, you could potentially determine if it’s a good fit for your requirements. If you progress, here are a few how to make it occurs:

Estimate your loan total The initial step to getting any loan begins with figuring out just how much you want. Make sure you cause of any relevant costs, eg prepayment fees from your own most recent lender and origination charges from your own another one. If you intend with the asking for extra fund, are people also.

Check your borrowing from the bank A couple big things obtaining approved to have a good personal bank loan refinance are good borrowing and you can prompt money into the your very first loan. Examining their borrowing from the bank, each other the score plus report, will allow you to stop surprises and you will improve people problems one which just initiate the program procedure. It’s also sweet to learn how your own borrowing even compares to whenever you have your loan.

Search for has the benefit of Now you have first off evaluating a knowledgeable refinance has the benefit of. Carrying out an area-by-front side set of loan providers makes it possible to compare rates of interest, monthly obligations, transaction costs and you will minimum credit ratings in order to qualify. Bear in mind that you could get hold of your most recent financial to explore possibilities also. Once your record is complete, have fun with an on-line unsecured loan calculator to guess monthly obligations.

Get the individual data files in a position Very loan providers request comparable records because of their application process. Such generally were proof of term, proof of home, proof of money, a personal Security card and you may W2 mode.

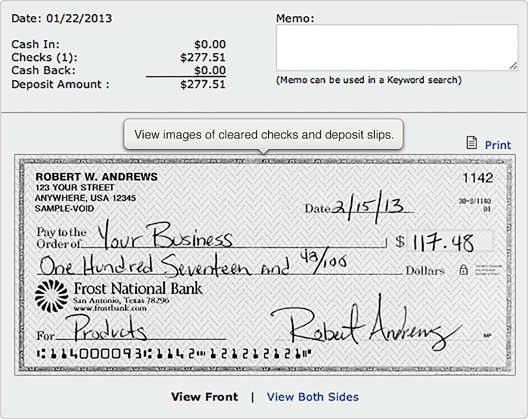

Apply for a refinanced financing When your preparing is finished, it is time to initiate the program techniques. Certain loan providers enable you to pertain myself or online and render your a response within a few minutes. In the event that acknowledged, you are because of the option of finding their fund from the see otherwise direct deposit.

Repay their dated mortgage and you may show it’s finalized In case your this new finance appear, repay the old financing quickly. Some lenders can perform this to you, however it is your choice to ensure it is finalized. In any event, pose a question to your dated bank to own a made-in-complete page for your records. It’s also advisable to look at your credit history to confirm the loan might have been paid off and the membership was closed.

Manage your this new mortgage Make note of your brand-new percentage day and you may number due each month. In the event the the lender also offers automatic money, registering could loans for bad credit and self employed help stop prospective later charge. Make sure to search for almost every other easier attributes particularly paperless billing, on the internet account government and you will a cellular app.

This new ball’s on your own court

Refinancing a consumer loan might be an excellent option to lay more funds on your pouch, step out of debt sooner otherwise make you additional time so you’re able to repay a loan. Once you make sure to weigh the huge benefits and you will disadvantages out-of refinancing a personal bank loan, you can make best choice for the budget.

What on this page exists for general degree and you will informative objectives merely, without any show or suggested promise of any sort, as well as warranties out of reliability, completeness otherwise physical fitness for variety of goal. It is not supposed to be and won’t create financial, legal, taxation and other advice specific to you the consumer or other people. The companies and people (apart from OneMain Financial’s paid people) referred to in this message commonly sponsors out of, do not promote, and are usually perhaps not if you don’t affiliated with OneMain Economic.

Recent Comments