step 3. Lower your loans-to-money proportion

The debt-to-earnings ratio or DTI is a portion that represents exactly how much of the month-to-month income try eaten upwards by your debts. So you can calculate their DTI, just seem sensible the monthly minimal loans repayments and you may divide one count by your month-to-month terrible pre-tax earnings.

Loan providers usually assess 2 kinds of DTI when you apply for a home loan: front-prevent and you will back-prevent. Leading-avoid DTI merely considers your houses-relevant costs (monthly home loan repayments, mortgage insurance rates, etcetera.), given that right back-end DTI takes into account your entire monthly debt burden, including your upcoming mortgage payments.

Preferably, you will have a front-stop DTI away from only about twenty eight% and you may a back-prevent DTI regarding just about 36% – although some kind of mortgage loans, especially bodies-recognized ones, allow large DTIs.

In case the DTI is on the better front, you could potentially obviously straight down it by paying down loans. But when you has actually student education loans, it’s also possible to have the ability to lower it by making use of getting a living-motivated fees plan or because of the refinancing otherwise combining your own figuratively speaking.

Income-inspired cost preparations can be decrease your government student loan monthly obligations from the attaching the amount due to a portion of income. This new hook? Not all the financial applications look at the adjusted monthly obligations generated as a consequence of the income-driven payment plan since a reduced debt obligations (on one to later on).

On the other hand, should your mission would be to decrease your DTI by the merging otherwise refinancing their funds, you will need to choose a lengthier fees name which have a reduced monthly payment – meaning that you will likely shell out regarding your funds on the Epes loans long term. For individuals who only refinance their funds to find a far greater appeal rate, that require in reality reducing your own cost label having huge monthly payments, it wouldn’t make a dent on your own DTI.

An increasing number of states offer student loan fees guidance applications for these ready to relocate otherwise get property there. They do this in the way of has, grants, tax waivers otherwise loans. The brand new deals usually are restricted to individuals with government student education loans.

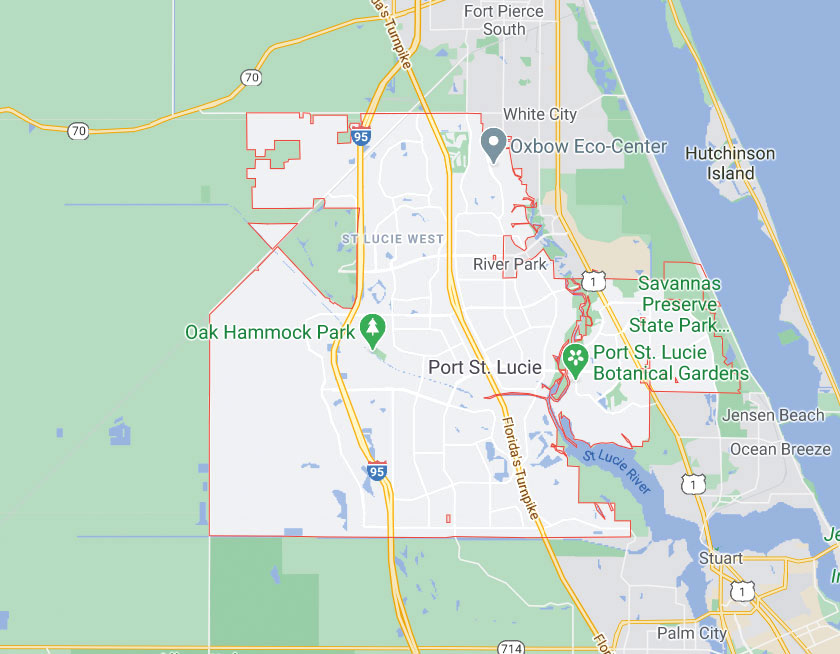

Eg, Kansas offers to spend so you’re able to $15,000 over 5 years for those willing to relocate and you may work in just one of their 95 outlying chance areas. St. Clair State for the Michigan, additionally, has the benefit of an opposing scholarship from $fifteen,000 towards the scholar loans fees so you can previous people exactly who circulate back family and get a research, technical, technologies, arts otherwise math education.

You can even seek advice from connectivity or teams about the career. If you’re an attorney, including, the new American Pub Organization features a summary of states offering student loan payment recommendations for graduates doing work in individuals field.

In the event applying for one among these applications wouldn’t instantaneously alter your DTI or the possibility to find acknowledged for a financial loan, it could yes help you to get truth be told there reduced.

5. Know the different kinds of mortgage loans

Antique finance are produced by the individual loan providers. So you’re able to qualify, they often need at least credit rating regarding 620 and you will an effective DTI less than forty five%. You’ll get a conventional loan with very little while the step three% down, but if your deposit is actually below 20%, their bank I), to manufacture your own monthly premiums higher priced.

Extremely old-fashioned finance are also conforming money, and therefore it meet up with the requirements getting ordered by the Fannie Mae and you may Freddie Mac computer. These regulators-paid organizations get fund of private loan providers, but never offer the exact same guarantees in order to lenders given that authorities-supported loans.

Government-backed money, including USDA, Virtual assistant and you may FHA finance, do have more lenient credit history requirements than conventional fund since the form of bodies institution you to backs all of them up takes on a few of the threats when your debtor non-payments. As a result of this nonetheless they generally have down rates of interest than simply old-fashioned fund, cannot always wanted home loan insurance coverage and you will, in some instances – like that from Va loans – you don’t need to place anything off initial.

Recent Comments