A beneficial USDA structure mortgage is a kind of mortgage considering by way of the us Agencies out-of Agriculture (USDA). These types of financing are created to assist someone into loans for bad credit New Site AL open today the outlying parts fund the construction out-of a special house or apartment with USDA-supported investment from Unmarried Loved ones Domestic Secured Mortgage Program.

Regardless if you are starting to mention the options otherwise you may be in a position in order to diving on the app processes, this article is designed to give you a definite understanding of how USDA design money performs and just how you could influence all of them to take your ideal home to lifetime. We’re going to take you step-by-step through just what USDA construction loans was, plus trick has actually, conditions, and you can pros and cons; up coming, direct you new strategies so you can safe an excellent USDA construction mortgage so you can create your fantasy domestic.

Single-Romantic Finance

Perhaps one of the most simpler popular features of USDA structure finance is actually that they’re solitary- or you to-time-personal funds. This is why the mortgage techniques is actually simplistic into that app plus one closure processes for the framework phase together with finally home loan.

For some other mortgage apps, strengthening a separate home demands several loans: you to definitely on the design stage and another with the home loan once the home is created. Every one of these financing must glance at the closing process directly.

Yet not, having good USDA solitary-close framework loan, individuals only have to glance at the closing processes after. This besides preserves some time decreases documentation but also minimizes closing costs.

Construction-to-Long lasting Loans

Having low-USDA structure funds, the transition from the 1st build loan so you can a long-term mortgage will likely be cutting-edge and expensive. However, USDA single-close design money are made to effortlessly transition on the build stage towards the long lasting mortgage without needing most funds otherwise refinancing.

USDA design-to-permanent money merge a homes financing which have a classic USDA loan in one single mortgage. Once your new house is completed, your build loan often instantly transition to a vintage 30-season fixed-rate USDA financial.

Framework Loan and no Money Down

One of the most superior features of USDA construction funds try the ability to money your brand-new home create without down payment. This really is a rare brighten as compared to most other build fund since conventional lenders often wanted a serious deposit to have more substantial upfront pricing.

USDA Build Mortgage Requirements

Just like any USDA loan, new homebuyer have to satisfy money and qualifications conditions, and also the assets have to be from inside the a beneficial USDA-acknowledged area. But not, certain more fine print exist, including:

- The home matches latest IECC, otherwise subsequent password, to own thermal requirements.

- The fresh homebuyer need to located a unique framework promise on builder.

- People way too much money from the development need go myself towards the the newest mortgage concept.

- Fund ily family, are available domestic, otherwise qualified condo.

USDA Acknowledged Contractors

The latest USDA requires that the lender agree any developers or designers you need to play with. Into the specialist or creator getting entitled to help make your household with the USDA mortgage, they have to:

- Provides at least 2 years of expertise building single-relatives home

- Give a casing or contractor license

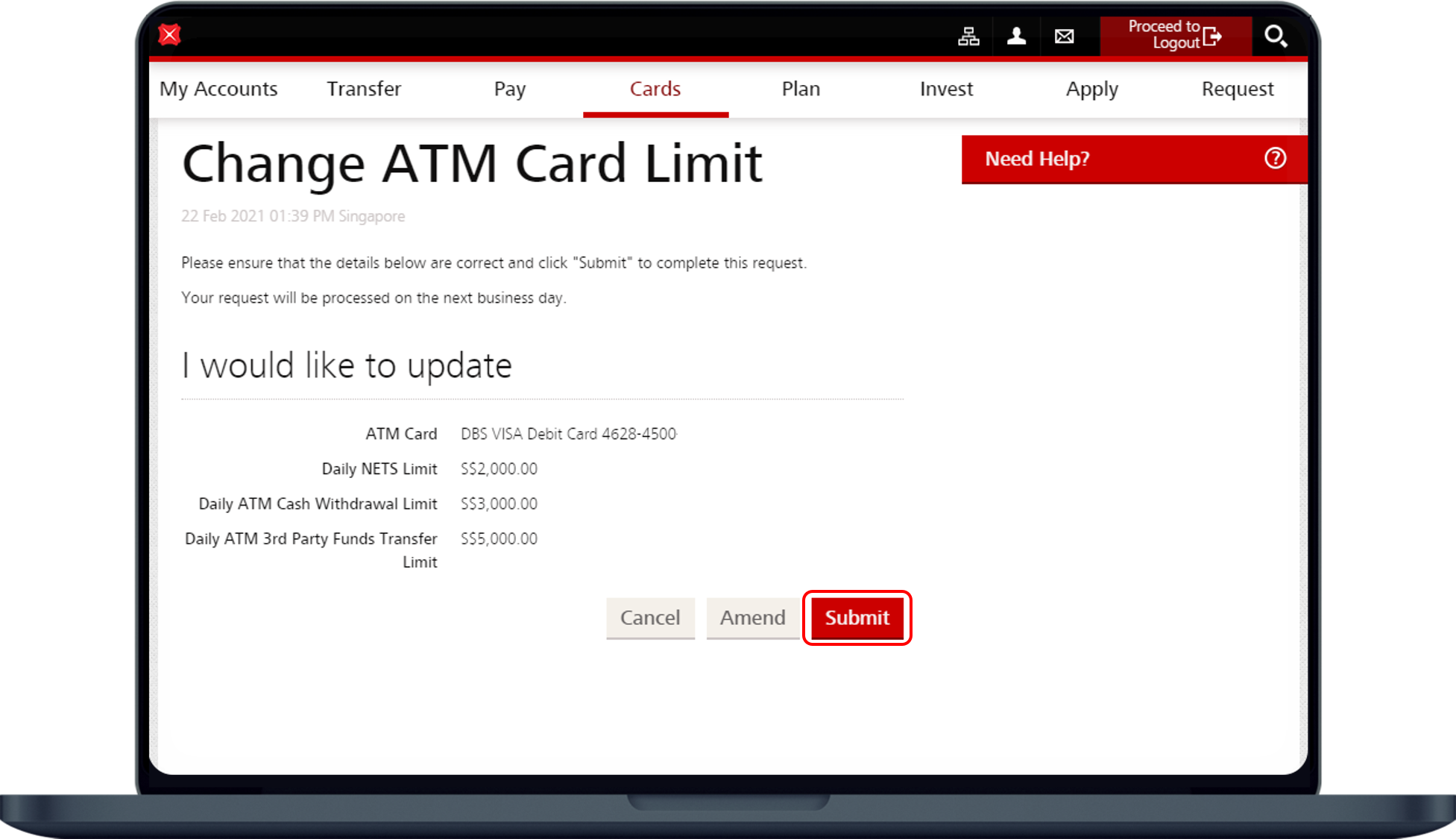

Ways to get a USDA Framework Financing getting Home building

If you’re considering a great USDA unmarried-intimate build mortgage, here are the methods you will want to follow to increase the possibility out of approval and make certain a smooth sense.

step 1. Look Lenders Whom Promote USDA Design Fund

The first step is to get a loan provider which provides USDA structure loans. Mainly because finance is less frequent, contrasting lenders might require some extra effort.

Start by contacting banks and borrowing from the bank unions close by, since they are expected to be familiar with what’s needed of your local communitypare the assistance, rates of interest, and fees off several lenders offering USDA design money to get the best matches for the financial predicament.

2. Come across good USDA-Approved Company

After you have a lender planned, the next phase is to decide a contractor otherwise builder whom is approved by the USDA. This is exactly essential, because the a medication specialist is actually financing needs.

The lender may provide a summary of acknowledged builders, or you can contact the newest USDA yourself to possess recommendations. Make sure your chosen builder has experience inside the completing plans you to satisfy USDA conditions and rules.

step 3. See Land in a beneficial USDA-Eligible Urban area

Before you can proceed, you ought to secure a parcel of land inside the a location that is eligible for USDA resource. USDA funds developed to market growth in outlying components, so that the property must fulfill specific area criteria to help you be eligible for a beneficial USDA framework financing.

Recent Comments