Nonconforming loan providers the name appears to suggest exposure, but is delivering a home loan courtesy an effective nonconforming financial very people reduced safe than credit as a consequence of a traditional bank?

A good nonconforming home loan are a loan offered to some one to shop for assets whom will not pass basic lending inspections and you may balances, Tindall says, adding discover a selection of factors borrowers rating banged back away from banking companies whenever making an application for a home loan.

Studies skills director Sally Tindall says if you get knocked right back from the lender, definitely explore your entire options prior to moving toward a good nonconforming loan

A debtor could have a poor credit history, an erratic income, otherwise an incredibly small put with no obvious history of having the ability to conserve, which will cause the bank so you’re able to forget when determining its financial application.

Compared with the major four banks and you will next tier lenders, non-bank lenders dont collect places from homes and do not hold a financial license out of APRA.

Throughout the 20 percent of the 110 mortgage lenders within the Australian continent are believed non-financial loan providers and only a small number of these types of, including Pepper Currency, Los angeles Trobe and you may Liberty, specialise within the nonconforming money, she says.

Mortgage broker and holder off PFS Monetary Qualities Daniel O’Brien says nonconforming loan providers fill a space on the market in order to look after particular individuals considered the wrong because of the banks.

They essentially specialise from the stuff that are outside of the field, such as for example borrowing from the bank disability, self-employed individuals with no, otherwise limited, financials and you can people with hit its maximum borrowing from the bank capabilities from the popular loan providers, according to him.

Normally new low-guaranteeing choice actually a permanently alternative, its a temporary substitute for make them cleared right up, he states.

Company success coach within Advantages Agents Category and former large financial company Mario Borg claims nonconforming finance tend to started in the increased price given that debtor is seen as being so much more risky.

It’s always gonna be increased rate of interest, according to him. Exactly how highest could it possibly be? Better, it depends in your problem.

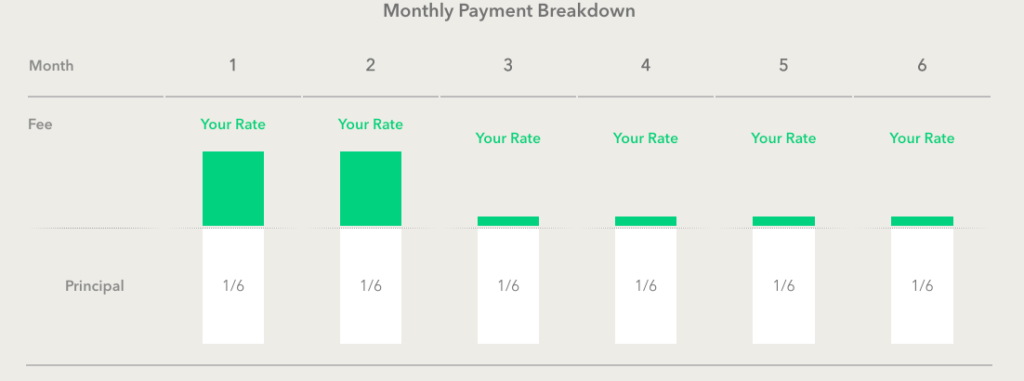

In some instances, the rate try personalised as opposed to getting that proportions suits every and certainly will rely on situations like your mortgage so you can worth ratio, whether you’re self-employed with little files and you will if or not your was bankrupt.

Tindall says the better price of nonconforming fund would be considered up cautiously by borrowers. You to nonconforming financial, Pepper Currency, has prices between six.84 per cent to %.

Canstar studies have shown a great $600,000 financing more a thirty-year name manage be more expensive than simply $29,000 more over five years whether your interest is but one per cent greater than an average holder occupier rates regarding six.twenty-eight %.

Mortgage loan that is dos % large would costs more than $60,000 whenever you are a speed step 3 per cent large manage costs better over $ninety,000 in the same period.

Tindall says borrowers given nonconforming lenders tend to ponder in regards to the safety and you will economic balance of these an option, nevertheless probability of getting affected by the lender heading chest try minimal. In terms of home loans, its well worth reminding yourself these are generally the ones loaning the funds, she says.

In the event the lender ran stomach right up, probably one of the most likely situations is that the lender’s mortgage guide is bought out by the more substantial facilities plus financial carry out import all over.

O’Brien consented: In the event the a lender goes tits, a customer would not eradicate their residence, he says. The financial institution manage be taken over, therefore the client’s home loan is simply branded another thing, otherwise a client you are going to re-finance.

step one. You should never suppose: Not totally all self-employed individuals or individuals with short dumps has to endure nonconforming lenders, therefore it is usually worth examining the options with popular loan providers basic.

2. Never diving inside the: It may be some time now before you can re-finance out-of a higher level nonconforming home loan into a good traditional financial so cannot deal with an acutely highest interest rates if you fail https://www.clickcashadvance.com/personal-loans-ny/lawrence/ to perform the new money across the foreseeable future.

Regarding borrowing from the bank impairment, good nonconforming financial is behave like a great washer by giving a route back into the house or property business or a great answer to combine debts, he states

3pare your options: You can also feel as if the back is up against the wall surface, but there is however likely to be several option readily available for you, so be sure to score advice regarding a reliable large financial company, financial agent and accountant whenever you are speaking with household members and you can acquaintances whom have the same position.

Recent Comments