All about cryptocurrency

HODLing is ideal for those who believe in the long-term potential of specific cryptocurrencies such as Bitcoin or Ethereum and are willing to weather short-term price fluctuations https://australiancasinolist.com/. While this strategy requires patience, it may provide substantial returns over time.

Inexperienced and institutional investors often focus on round-number prices, which affect support and resistance levels. For example, when Bitcoin’s price approaches a round number like $60,000, it frequently becomes a resistance point.

A cryptocurrency’s tokenomics are of paramount importance, as they determine the cryptocurrency’s total supply, distribution, and its incentive mechanisms. These are factors that often have a direct impact on the cryptocurrency’s price movements.

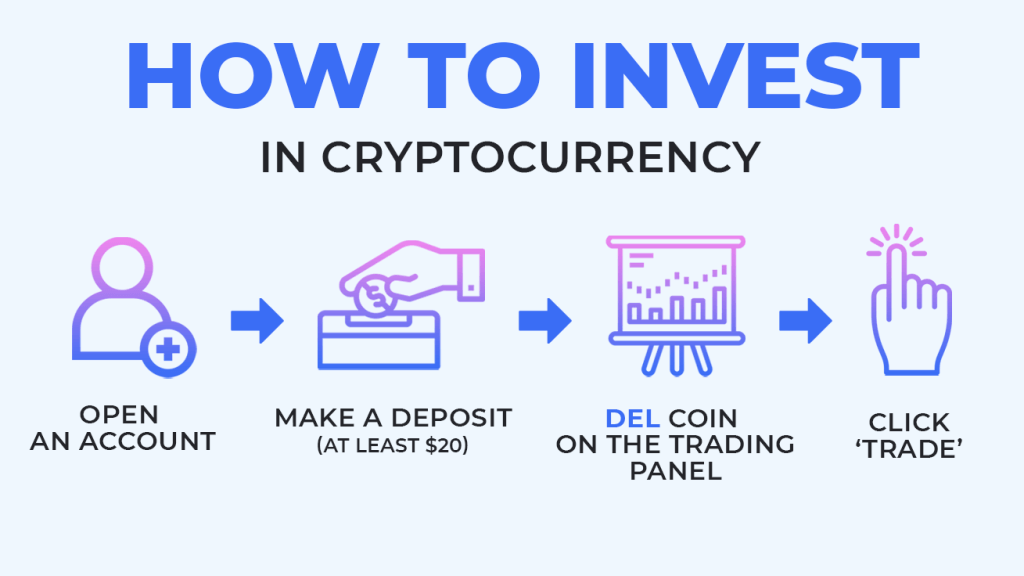

All about investing in cryptocurrency

A candlestick is made up of four data points: the Open, High, Low, and Close (also referred to as the OHLC values). The Open and Close are the first and last recorded price for the given timeframe, while the Low and High are the lowest and highest recorded price, respectively.

Fundamental analysis for cryptocurrency involves evaluating two important factors – on-chain and off-chain metrics. On-chain metrics include network hash rate, wallet addresses (active and dormant), network applications, token/coin issuance rate (inflation/deflation), network fees, and transactions.

A candlestick is made up of four data points: the Open, High, Low, and Close (also referred to as the OHLC values). The Open and Close are the first and last recorded price for the given timeframe, while the Low and High are the lowest and highest recorded price, respectively.

Fundamental analysis for cryptocurrency involves evaluating two important factors – on-chain and off-chain metrics. On-chain metrics include network hash rate, wallet addresses (active and dormant), network applications, token/coin issuance rate (inflation/deflation), network fees, and transactions.

All about cryptocurrency for beginners

Bitcoin (BTC), created in 2009 by an anonymous individual or group of individuals using the pseudonym Satoshi Nakamoto, is the first and most well-known cryptocurrency. It was designed to be a decentralised digital currency, enabling peer-to-peer transactions without the need for intermediaries like banks or financial institutions.

This makes USDT particularly useful for traders looking to hedge against market fluctuations and for businesses seeking to leverage the advantages of blockchain technology without exposing themselves to the volatility of other cryptocurrencies.

People often invest in crypto in a few different ways: as a personal hobby, a wealth-building strategy, or as part of their profession. The crypto investment buzz has made hobby-level investing popular, particularly among younger investors. Here are two approaches to cryptocurrency investments:

Recent Comments