They supply the evidence wanted to service their deduction says, guaranteeing you could make the most of their income tax positives instead of any trouble.

Assess Very first and you may Next Mortgages

Understanding the difference in very first and you may second mortgages is crucial, particularly when choosing in case the house equity financing desire are tax deductible. Very first home loan is the completely new loan you got to buy your house. A home guarantee financing is usually experienced a moment financial – it’s a lot more borrowing contrary to the guarantee you manufactured in your home.

The fresh new category of these fund is very important having income tax purposes, just like the Irs limits the new deductibility interesting according to the shared overall. To evaluate the mortgage loans and understand their influence on taxation masters:

Remark Loan Comments to own Quality

Assemble the most up-to-date comments to suit your first-mortgage and house security loan. Pick installment private loans Blue Mountain secret info such as the left equilibrium, interest additionally the time the mortgage are applied for. This article is crucial to facts where you’re with each mortgage.

Assess Shared Amount borrowed

Seem sensible brand new an excellent balance of one’s first mortgage and you will household collateral mortgage. This new combined profile is important since Internal revenue service limitations simply how much loan attention are going to be deducted. Knowing this complete can help you assess your position in line with this type of limitations.

Examine Up against Internal revenue service Limits

The fresh new Irs allows notice deduction on the mortgage numbers around $750,000 to possess single filers or $375,000 having maried people filing ount with your thresholds observe when you are for the eligible variety for an income tax deduction.

Believe Loan Uses

Assess how you purchased the amount of money from your home guarantee mortgage. The Internal revenue service just allows deductions to own loans utilized for buying, strengthening otherwise substantially raising the taxpayer’s domestic. Ensure that your financing utilize aligns with the help of our requirements.

To possess constant administration, consider establishing a spreadsheet where you are able to on a regular basis improve your loan balance, interest rates and you will due dates. This will help to on the newest research and can become priceless to own upcoming economic considered and you can taxation 12 months.

Finding out how your first and you will next mortgage loans collaborate is key in choosing in the event the home security mortgage appeal is tax-deductible. Proper comparison ensures you accurately allege any qualified income tax advantages.

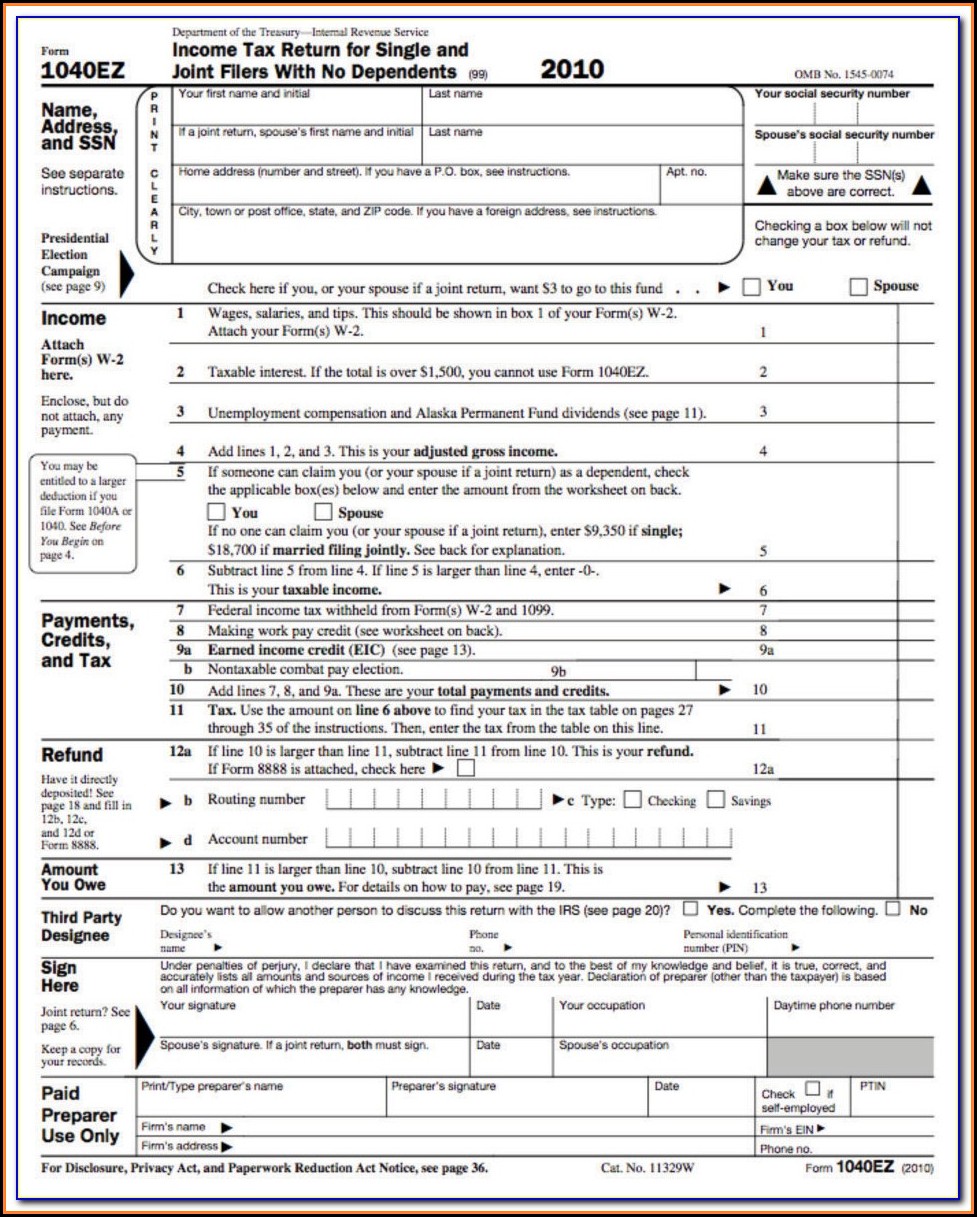

Claim Their Deduction

Stating their deductions involves filling out Internal revenue service Mode 1040 and you may attaching Schedule A. Into the latter, you can detail all your valuable itemized write-offs, such as the interest on the home guarantee financing. Precision is vital, thus ensure that the wide variety mirror just what you’ve computed and you will which they make together with your documents.

File such variations in your typical tax go back. You might complete them digitally using income tax applications, which give guided guidelines, or owing to a taxation elite. If you would like paper processing, you might post the fresh forms into Internal revenue service.

Pay attention to the annual taxation processing deadline, usually April 15, except if they drops towards the a sunday otherwise escape. If you would like more hours, you could consult an expansion, however, think about, which extends committed so you can document, not committed to spend any taxation owed.

By simply following such strategies and being aware of the entry processes and you can deadlines, you could potentially efficiently claim this new tax advantage of your property equity mortgage, making certain an easier and a lot more perfect taxation submitting sense.

Income tax Subtracting Situations

Its not all citizen that have a house guarantee financing will delight in the fresh new same taxation benefits. Personal circumstances, eg how much cash you obtain and you can that which you make use of the loan to have, play a life threatening role during the deciding eligibility. Navigating the new impact of the novel facts into prospective taxation positives can posting monetary conclusion and taxation planning, letting you optimize masters whenever feasible. Let us speak about this because of some other resident scenarios.

Recent Comments