This is often done through the “transfer” and “withdraw” sections of the cryptocurrency exchange interface. For this, you will undergo an identity verification process that includes your Social Security Number (for US citizens), an email address, and additional personal information. This ensures that your assets are connected to you once you purchase cryptocurrency and reduces the likelihood of fraud.

How Does Crypto Make You Money?

This means there is no centralized authority overseeing the transactions on a cryptocurrency’s blockchain. Binance Coin (BNB) is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or bitcoin.

Selecting the Right Cryptocurrency Exchange

The right portfolio tracker helps you keep an eye on your profits and losses and offers valuable market insight. With features like real-time updates and the ability to connect your wallet directly, these apps are indispensable for tracking your crypto portfolio. Whether you’re dealing with multiple exchanges, grappling with crypto taxes, or looking to streamline your buying and selling activities, there’s likely a mobile app that fits your needs. Active monitoring and analysis of your portfolio are integral to managing your cryptocurrency investment. Utilizing advanced analytics tools and market intelligence platforms can provide valuable insights into portfolio performance. Regular assessment helps in making informed decisions based on market trends, regulatory developments, and technological advancements.

Bitcoin Cash (BCH)

While there is a lot of glitter, we shouldn’t forget the disadvantages of investing in cryptocurrency. While funding crypto assets seems to be a lucrative opportunity, there is a certain risk of crypto investment that beginners and pros should be aware of. Ethereum is only one of thousands of other crypto assets available in the industry, each serving its specific function. Knowing the major types of cryptocurrency and the purpose of different crypto assets should help you decide which coins are worth adding to your cryptocurrency investment portfolio.

Global Economic Context on Inflation and Crypto Markets

- High trading volume suggests strong investor interest in a cryptocurrency, with active buying and selling.

- After you have made your cryptocurrency investment, it will need to be stored in a cryptocurrency wallet.

- If you are still unsure of what strategy to use, the 3Commas trading platform is the perfect way to start your cryptocurrency investment journey.

- The same also applies to the Tron network, whose community has created a WBTC version based on the TRC-20 token standard.

- This can allow them to establish long-term trends and potentially understand when best to open or close a position.

- Ethereum (ETH), on the other hand, can store both transactions and code in its blocks.

- Fidelity’s Wise Origin Bitcoin Fund net assets stood at $11.43 billion on Nov. 1.

- By diversifying across major cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins, you can manage risk and optimize returns.

If you’re looking to buy Bitcoin, pay particular attention to the fees that you’re paying. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Crypto Coins for Beginners: Comparison

You might choose Bitcoin, Ethereum, or something like Ripple as your core. Your satellites will be smaller projects or those cryptocurrencies you aren’t as confident in quite yet. That’s because these “programmable money” platforms use the tools available from the Ethereum network to locate the optimal interest rates at all times.

- Investing in cryptocurrencies can be risky because prices are highly volatile and investment can lead to large losses.

- However, those who want to participate in this market have to go through a steep learning curve.

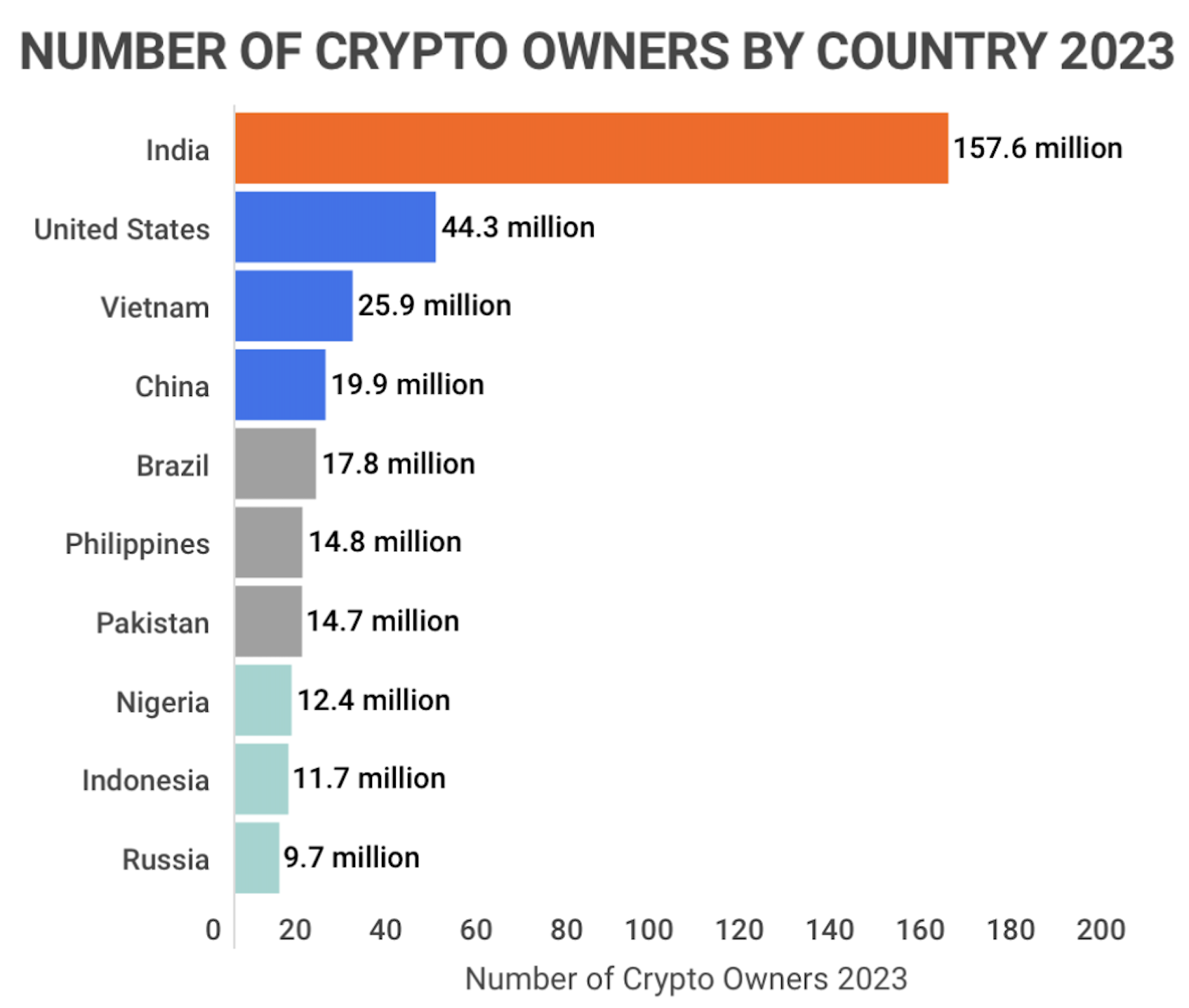

- According to Chainalysis, the South Asian country is the ninth in the world in terms of cryptocurrency adoption.

- Market data is provided solely for informational and/or educational purposes only.

- Uniquely, CoinStats offers users the opportunity to participate in DeFi liquidity mining.

Risks of Investing in Cardano

Extensive application of both FA and TA techniques is necessary when using this strategy. Scalping (a trading strategy in which traders profit off small price changes) is a part of day trading but typically involves concise trading periods. Do you want to be the kind of trader that prefers to get in and out of trading positions multiple times a day (i.e., day trader)? Instead, do you prefer to research and make informed bets every time (i.e., swing trader)? There are two main techniques to use to analyze and evaluate cryptocurrency.

Is crypto a good investment?

- In this section, we will explore some effective ways to stay informed and provide you with valuable resources to enhance your knowledge and understanding.

- Avalanche is a relatively new “layer one” foundational blockchain that can execute smart contracts.

- The utility of a crypto asset can significantly affect its value and growth potential, making it an essential factor to consider.

- Day trading is a type of short-term trading in which traders buy and sell their assets within the same 24-hour period.

- For the avoidance of doubt, a Jiko Account is different and separate from the Treasury Account offered by Public Investing and advised by Public Advisors (see “Treasury Accounts” section above).

- Bonds with higher yields or offered by issuers with lower credit ratings generally carry a higher degree of risk.

Though cryptocurrency blockchains are highly secure, off-chain crypto-related key storage repositories, such as exchanges and wallets, can be hacked. Many cryptocurrency exchanges and wallets have been hacked over the years, sometimes resulting in the theft of millions of dollars in coins. How much it costs to buy cryptocurrency depends on a number of factors, including which crypto you are buying. Many small altcoins trade for a fraction of a cent, while a single bitcoin will cost you tens of thousands of dollars.

Best IPTV Test 2025: How to Find the Right Provider Before You Subscribe

Cryptocurrency staking is the processes of locking coins in a wallet and receiving rewards in return. These can be thought of as equivalent to the dividends you might earn from holding certain stocks. Though just as bull runs don’t last forever, neither do bear markets and many investors are seeing this as a prime opportunity to get in at “discount” prices. However, cryptocurrency investments are still risky, and their widespread adoption is not guaranteed.

Cryptocurrency Vs. Traditional Money: What’s the Difference?

That includes understanding what the blockchain is, how Bitcoin and some notable altcoins work, what crypto wallets are, and so on. Buying cryptocurrency stocks is a great way to leverage the potential of the cryptocurrency market without buying crypto coins or tokens directly. In essence, you’re buying stocks in companies that have some degree of exposure to the cryptocurrency marketor blockchain technology. While analysts caution investors about the volatile nature and unpredictability of cryptocurrencies, some investors are willing to take the risk for the potential reward. It’s critical to do your research beforehand to determine if investing in cryptocurrency is right for you.

DeFi platforms operate on smart contracts on blockchains, primarily Ethereum. Considering the cryptocurrency market’s development, specific trends in asset allocation are observed. Technological advancements and innovative use cases are driving new portfolio approaches that provide both certainty and prosperity for crypto investors.

While focusing on diversification within the crypto market is essential, it’s also important to consider incorporating traditional assets into your overall investment strategy. Adding stocks, bonds, or commodities like gold can provide a further layer of diversification and help stabilize your portfolio against extreme fluctuations in the crypto market. For this reason, this is the feature we list among crypto pros and cons.

Correlation Risk

Believe it or not, popular cryptos like Bitcoin and Ethereum are barely used for retail transactions in India. With technological involvement and industrialization, digital currencies, Cryptocurrency investments such as Bitcoin, are gaining a satisfactory position over others. Cryptocurrency makes it easy to transfer money without any involvement of banks and other financial institutions.

Strategy #7: Market cycle investing

CoinTracker is another tax reporting tool that integrates with wallets and exchanges to provide detailed transaction histories. These platforms integrate with exchanges and wallets to generate detailed tax reports that comply with local tax regulations. Below are some of the most common types of platforms used for cryptocurrency portfolio management. These tools provide insights, automate processes, and help investors make informed decisions. Futures and perpetual contracts allow investors to take long or short positions on cryptocurrencies without owning them. For example, Bitcoin and Ethereum often show high correlation, meaning they may not provide much diversification when held together.

This lets Solana achieve a speed of up to 65,000 transactions per second (TPS) and confirmation time in less than a second. This greatly outperforms competitors like Ethereum, one of the best crypto investments for day trading. Coinigy allows transaction history imports and generates crypto tax reports for investors and traders, which can be shared with tax professionals. The tool features an automatic import from exchanges and presents a unified dashboard that displays comprehensive information about a user’s crypto assets. The dashboard showcases real-time token prices, historical data, deposits, withdrawals, market caps, and concisely illustrates the user’s portfolio performance.

Strategy #3: Copy trading

Though they claim to be an anonymous form of transaction, cryptocurrencies are pseudonymous. They leave a digital trail that agencies like the Federal Bureau of Investigation (FBI) can follow. This opens up the possibility for governments, authorities, and others to track financial transactions. The remittance economy is testing one of cryptocurrency’s most prominent use cases. Cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders.

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. To determine the best entry and exit positions, use technical analysis tools and indicators to pinpoint trends, support, and resistance levels. You may benefit more by using technical analysis tools and indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands. Day trading is generally referred to as the trades or positions that are opened and closed within the same day. Traders usually use market indicators, chart patterns, and technical analysis to determine when to enter and leave a trade.

Recent Comments