Financing Conditions

So, things does which means that in practice? In the first place, you need to figure out how far money you want to borrow and you will think about the investment limits of the prospective bank. Be sure to look at the kind of house recovery loan you desire; typically, companies provide personal personal loans getting renovations, and this is what the studies work on.

These kinds together with takes into account almost every other extremely important things particularly mortgage handling times, payment conditions, and any possible hidden otherwise bonus costs which aren’t instantly obvious. All these situations tie for the all of our next classification.

Ongoing Can cost you

I adore low interest rates home improvement funds, but one thing score complicated if you have to figure out how far your loan will in actuality charge you. This category examines most of the will cost you and you may fees which you’ll has to invest for the duration of the loan. Might interest was an obvious personal loans for bad credit Connecticut example, but the real pricing will be much better illustrated by your annual percentage rate or Annual percentage rate. Be sure to take notice regarding more will cost you that started connected with your house update financing, such as for instance origination, cancellation, and later payment charges.

Customer satisfaction

The last factor when looking for a knowledgeable repair financing in the industry is how far effort the company trailing they throws into forging an excellent consumer relationshipspanies with a decent character make you comfort, but those who supply the information you need within the a fast manner try more better. This category considers both the company’s societal visualize and you may available buyers support channels. We have a look at both the Bbb get and online consumer studies when you are evaluating the methods where company brings customer service and you will tech assistance.

Just how do do-it-yourself fund really works?

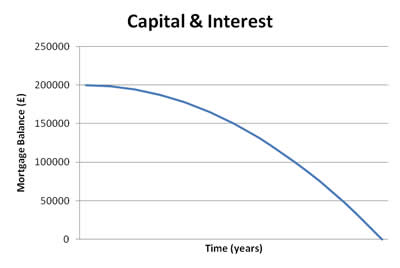

Generally speaking, do-it-yourself money can be associated with the unsecured unsecured loans you to definitely defense the expense of household updates. There are also family security loans otherwise family guarantee lines from borrowing from the bank. All of them display that trick trait; if you be eligible for the borrowed funds, the lending company enables you to borrow money towards restoring or upgrading things inside your home, plus come back, you’ll repay them the cash having attract courtesy fixed monthly obligations.

What sort of mortgage works well with funding renovations?

When trying to find out the best way to loans home developments, you should imagine multiple issues. Earliest, regulate how far currency you want and you will exacltly what the credit rating is actually. Those two can enjoy a role for the limiting your home upgrade capital possibilities.

Whenever try property upgrade mortgage a good idea?

Property improvement mortgage is always a great idea whether it enhances the value of your property and you can produces your residence secure otherwise agreeable that have regional otherwise regional regulations. You need to work out how far money need, just how urgent work are, and you may in case your month-to-month funds are capable of the extra strain of mortgage repayments.

What credit score is needed for a property improvement financing?

So you can be eligible for an informed do it yourself funds, you’ll need a good credit score. Having said that, there are lots of firms that you could turn-to getting pretty good do-it-yourself loans even with a poor credit get. Minimal credit history for a home upgrade financing with many organizations is just about 600 or finest.

Behind brand new Fortunly title stands a small grouping of enthusiasts – connoisseurs of everything financial – united as much as one goal: to really make the challenging realm of money offered to men and women.

Recent Comments