In which this is actually attractive is if you to definitely doc I pointed out got college loans and you will are choosing Public service Loan Forgiveness (PSLF). However their PsyD mate did not have money. It breadwinner loophole manage lessen the datically. Hence do notably all the way down its total cost if you find yourself pursuing the PSLF program.

Whenever you are curious to learn more, listed below are some Student loan Planner Podcast Episode six, in which we discuss the breadwinner loophole in detail.

When both partners enjoys student loan obligations and tend to be for the a keen IDR plan, processing taxation alone brings little or no loss of student education loans. It usually turns out costing the happy couple way more in taxation than simply they preserves all of them in the financing installment.

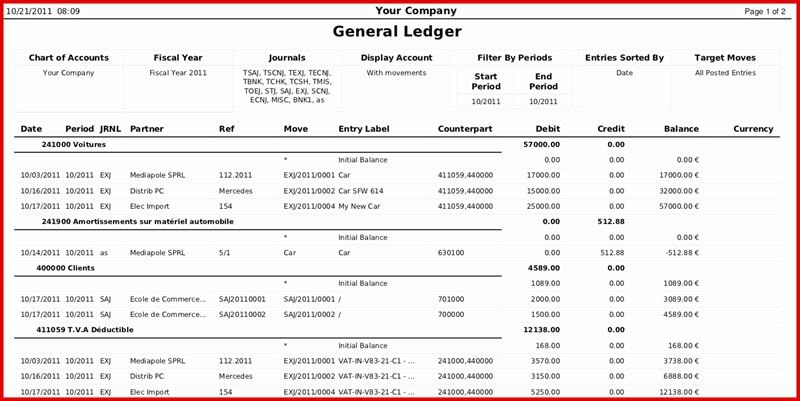

What if one both are into the PAYE and they file the taxation as one. One to lover helps make $150,000, and also the most other helps make $fifty,000 – 75% from domestic earnings and you may twenty five% from family income.

The loan servicer tend to determine the household commission according to the home money out of $200,000. Of the monthly payment count, 75% goes to your finance of your $150,000 earner. Others twenty five% goes towards the funds of the $50,000 earner.

Whether or not it few was to document fees on their own and you can approve their money making use of their private tax statements, they may possess significantly down costs because of an additional deduction on the discretionary money.

Filing Separate When you One another Have Student education loans on the Cut Package

Consumers will see you to in Help save plan, you could potentially help save much more about your loan https://paydayloancolorado.net/leadville-north/ repayments than submitting independent costs.

The reason being this new deduction for the Save bundle was 225% of impoverishment line based on your loved ones dimensions.

For those who document taxation ily dimensions minus step one. But when you keeps college students, only 1 mate gets to claim them to possess family members size objectives.

Thus, state for every partner inside the children away from five brings in $fifty,000 per year. 225% of your own impoverishment range to possess a household of four was $70,2 hundred.

Filing ily size 3 and another borrower to make use of family members size step 1. They can earn all in all, $91,980 just before paying something.

10% of one’s difference in deductions is mostly about $dos,000. Anytime submitting independent will cost you lower than $2,000, you really need to document separate even though you both keeps fund.

You can view exactly how effective filing separate could be within the new Conserve statutes, for even individuals who will be each other to make repayments. That it mathematics is a lot different than the outdated legislation.

Tips cut the essential currency trying to repay figuratively speaking

There is big money on the line when our company is these are trying to repay four or half a dozen-contour student loan obligations. It seems sensible to have an expert to review your unique problem while delivering loved ones dimensions, industry street, domestic earnings, cost number, forgiveness apps and you will financial specifications under consideration. This is especially valid today, due to the Save laws you will definitely change just how really individuals pay the student loans.

So it holistic means will guarantee you are protecting more currency in addition to consider other variables, instance being qualified for Medical health insurance Marketplace deals.

All of us possess aided tens of thousands of clients do successful repayment and you will refinancing techniques to undertake the beginner obligations. We had prefer to help you fundamentally be confident about precisely how you are dealing with your own college loans and rescue as much currency you could.

Once a scheduled appointment with us, you are able to comprehend the street that may help save you the absolute most currency whenever trying to repay their finance. You will also obtain the understanding you will want to end up being in control.

Uncertain what direction to go with your college loans?

Just take our eleven question test locate a customized recommendation to have 2024 to the if or not you really need to go after PSLF, Biden’s Brand new IDR plan, or refinancing (for instance the that financial we think you can expect to provide the finest rate).

Recent Comments