What’s a secondary Loan?

A secondary financing normally reference a fees mortgage where the lending company possibly the first issuer of the financial obligation or perhaps the most recent proprietor of one’s financial obligation doesn’t have an immediate reference to the brand new borrower.

Secondary finance can be found courtesy a 3rd party with the assistance of a mediator. Loans exchange from the additional markets can also be thought secondary finance.

http://www.elitecashadvance.com/personal-loans-ct

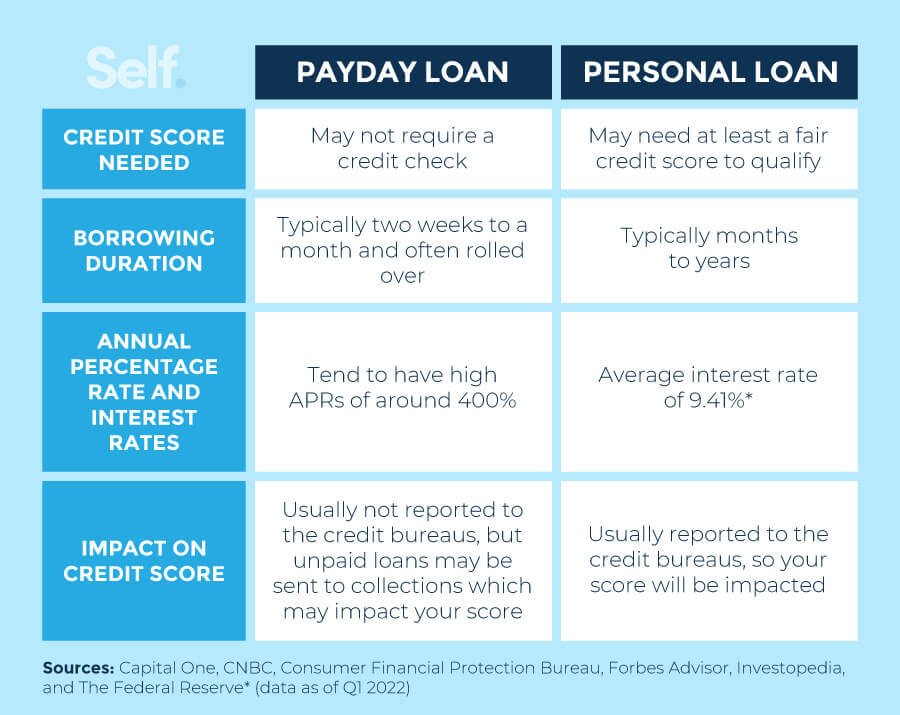

By permitting individuals to find investment because of third-people relationships, secondary financing will help to improve capital availableness and you can exposure management. Tend to individuals who don’t be eligible for a primary financing can also be decide getting an indirect loan instead. Indirect financing are far more pricey carry large interest levels, that’s than head money are.

Key Takeaways

- Having an indirect loan, the lender doesn’t have an immediate connection with the debtor, who has lent away from a third party, set up by the a mediator.

- Secondary financing are often utilized in the automobile community, that have investors helping people support money courtesy their system away from monetary organizations or other loan providers.

- Indirect money are generally more pricey than just lead funds, since they’re tend to utilized by individuals just who may not or even qualify for a loan.

Understanding an indirect Mortgage (Agent Financial support)

Many dealerships, resellers and you may retailers one deal with big-citation points, instance autos or entertainment vehicle, are working with numerous 3rd-party loan providers to greatly help their customers get fees money to have requests. Dealerships often have lending networks that come with multiple monetary associations ready to contain the dealership’s sales. Most of the time, these firms might be able to accept a bigger selection of individuals making use of their community connection with brand new broker.

Regarding the secondary loan process, a debtor submits a card software from dealer. The application will be delivered to new dealership’s investment system, allowing the fresh borrower to get multiple now offers. New borrower are able to choose the best loan because of their state. New dealership and additionally masters, in this, because of the improving the customer discover financing, it can make new business. Due to the fact interest towards the specialist might higher than away from a cards connection otherwise lender, it certainly is ideal for people to test most other financing choice just before agreeing to invest in their car owing to a provider.

Although this version of indirect mortgage might be called “broker financial support,” that it is this new dealer’s network creditors which can be granting the newest loan (according to research by the borrower’s borrowing from the bank character), form their words and rates, and you can gathering the new money.

In the event a secondary financing is offered as a consequence of a distributor or retailer, an individual is largely credit from a unique lender.

How an indirect Mortgage Really works (Second Industry)

Money perhaps not originated directly by financial one holds all of them can meet the requirements secondary loans. Whenever a lender carries that loan he could be not responsible because of it or get any interest earnings of it. Instead, everything is moved to a special proprietor, who assumes the duty regarding giving the mortgage and you will accumulates the latest payments.

Understand one secondary loan package carefully: If for example the agent usually do not promote the mortgage the customer finalized to help you a lender, this may have the straight to terminate the price in this a great specified period of time and want the consumer to return this new vehicles. The customer will then be permitted come back this new down-payment and trade-into the (or perhaps the value of the latest trading-in) in the event the a swap-for the try involved. In this instance, the latest specialist may attempt to stress an automobile visitors so you’re able to sign yet another deal on the less beneficial conditions, although customer is not needed to indication they.

Secondary Loan Instances

Automobile dealerships are among the most typical companies associated with indirect funds; in fact, specific regulators even call indirect financing a kind of car loan.

Of a lot customers explore specialist-funded money to your convenience of having the ability to use on the-properties and also to easily examine now offers. With the drawback, acquiring a car loan directly from a financial or borrowing relationship on his own offers the client way more influence to help you negotiate, plus the versatility to shop to certainly one of other loan providers. And the rates of interest was most readily useful. However if a buyer keeps an effective spotty credit score otherwise lowest credit rating, an indirect financing could be their finest solution.

Loans definitely trade into the additional areas too especially, a swimming pool away from money that have been shared rather than individual finance. Usually a lender otherwise borrowing from the bank union carries its user fund otherwise mortgages; doing this lets lenders discover brand new funding, eradicate administrative costs and would their amount of risk.

At home-lending ple, the latest Federal national mortgage association (Fannie mae) and you will Federal Home loan Mortgage Corp (Freddie Mac) support the secondary trade off mortgages because of its loan apps. These two regulators-sponsored enterprises get home-backed finance out of lenders, bundle them right after which re-promote all of them, in order to support exchangeability and enhanced way to obtain loans around the the credit sector.

Recent Comments