Refinancing your financial will save you various if not thousands of dollars, together with there are many more an effective way to change your profit

If you are looking to save cash-if not get some good more-there is certainly no finest spot to get it done than simply having your house.

Having interest levels close historic lows, refinancing the financial could save you hundreds if you don’t tens and thousands of dollars annually.

Those people are just a couple of methods for you to make use of house to change the money you owe, specifically with homes cost continuous to go up. The primary would be to take action properly-and also for the right explanations. You ought not risk borrow against your property when planning on taking an costly vacation. But you might want to set up a different sort of roof otherwise change your kitchen, that’ll boost the property value your residence alot more.

Even after all prospective masters, really residents bashful from refinancing possibly of fear, lack of suggestions, or even the faith that it is maybe not really worth the efforts.

So if you’re struggling with higher-interest credit debt, merging they which have a reduced-appeal mortgage is also a sensible disperse

The fresh overwhelming loans Marvel majority of home loan consumers haven’t yet , refinanced, despite listing-reduced rates over the past 12 months, states Greg McBride, captain economic specialist towards the on the web monetary web site Bankrate. According to a recently available survey of over step 1,000 property owners by Bankrate, 74 per cent off borrowers commonly refinancing their home loan.

The big a couple of reasons will be higher costs associated with brand new process and its particular go out-consuming characteristics. Newest prices to have a thirty-seasons repaired-rate mortgage mediocre on the dos.nine %, and most pre-pandemic financial owners are expenses step three.5 per cent or even more.

For people who understood you’re planning to save $10,000 in the next 5 years, you’d probably end up being willing to added a couple of hours of the go out so it month in order to it.

??My spouse asked about refinancing together with her relative who does mortgages, however, are informed that in case it was not preserving us more than a portion point, it was not worth every penny, states Eddie Vera, exactly who will pay step 3.5 % on financial he is had as 2017. I also provides a buddy who went through the process and you can didn’t end up being it absolutely was worth the nightmare.

The individuals inquiries enjoys merit, McBride claims. The expenses should be high. Banks charge a fee to give the new mortgage loans with a diminished rates that’s usually dos % so you’re able to 5 per cent of the loan. Even when that will soon add up to thousands of dollars, the fresh new rule of thumb is always to compare you to definitely number which have just how much you’ll save out of refinancing. Whenever you are saving more the latest costs (which utilizes how long you intend in which to stay the house), it is well worth performing.

As well as the process would be day-consuming-specifically once the work-from-house pandemic laws perform logistical bottlenecks that interrupt effective correspondence between lenders, borrowers, and other key people in the process. On top of those people questions, distrust of your refinancing community may be remaining particular individuals-especially those in Black colored and you can Latino groups-of capitalizing on potential deals.

Calling a good HUD-official casing guidance service may help alarmed consumers, says the latest Rev. Dr. Charles Butler, which facilitate focus on a north carolina-centered nonprofit that offers houses counseling or other area empowerment software.

For those who understood you had been likely to save yourself $ten,000 next five years, you’ll getting prepared to added several hours of one’s time so it month so you’re able to they, McBride claims.

Almost every other causes become too-much documentation, plans to disperse in the future, and you can inquiries you to its credit ratings commonly satisfactory

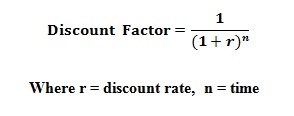

To help you show the point, Bankrate calculates that in the event that you has a thirty-year financing for $three hundred,000 at 4 percent, the monthly payment is actually $step one,432. Refinancing at step 3 percent would work to help you $step one,265, a discount out of $167 30 days or $2,004 annually.

Recent Comments