For individuals who lay bucks towards escrow for usage into the coming property tax costs, you will possibly not have the ability to subtract that it money.

How to begin toward Refinancing

The newest taxation ramifications of an effective refinance are going to be complicated. Before choosing so you can refinance, you are able to talk about the plan with a taxation professional and you will a mortgage professional. Proceed with the strategies lower than to begin towards refinancing.

- Make certain a great re-finance will benefit you: Figure out what your goal is actually and you will if refinancing can help you achieve they. Tend to which choice save you money? Are the newest cost lower adequate? If you undertake an earnings-aside refinance, ensure that with which currency today outweighs the extra numerous years of personal debt. Simply you could determine what the best choice is actually for your, but our mortgage advisors makes it possible to weigh the options.

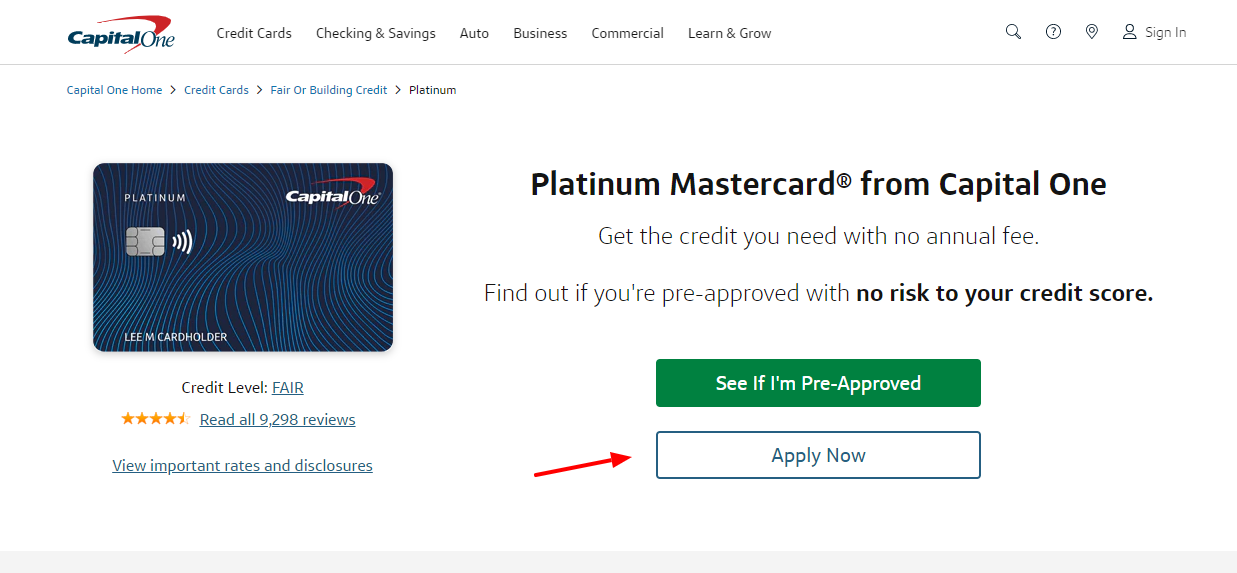

- Speak with a lender: For a long time, Assurance Economic might have been repair mortgages so you’re able to users. We aim to result in the procedure for refinancing fast and simple. You may be able to find pre-eligible to a beneficial refinance in only 15 minutes that have a free of charge, no-duty quote. Given that a different lender, we offer all the financing type of readily available, and we’ll manage the complete techniques from inside the-household.

- Over your own refinancing application: When you find yourself happy to re-finance, you could pertain with us online otherwise that have one of our mortgage advisors. We are able to make it easier to from measures and you will respond to questions you have got.

- Signal brand new disclosures: When you over the application, we’re going to give you your disclosures. You are able to indication these types of, if in case you choose, you could be certain that the loan terminology and make certain youre doing your goal off cashing away otherwise lowering your rate.

- Deliver the necessary papers: When you signal, you are going to fill out their documentation in order to us within Promise Monetary, including your money verification and you will resource verification.

- Fill in your loan requirements: After that an out in-home underwriter from the Assurance Economic gets their papers. The fresh new underwriter addressing the records usually inform us when the there try any products that may be required.

- Indication the very last documents: Once you’ve already been recognized for your re-finance, you are going to talk with good notary to help you sign one last records.

- Create your payments: Up to now, you may have complete new refinancing procedure. Just after 29 so you’re able to two months, you can begin and come up with your repayments for the this new home loan. If you gotten a cash-away re-finance, you are able to your money for your home renovations.

As the refinancing process normally very first be daunting, it will not need to be. Once you will run you from the Guarantee Economic, we make an effort to make fully sure your go refinancing their home loan is basic stress-free you could.

Re-finance With Guarantee Financial

During the Warranty Economic, we all know all of our customers are active. Our very own subscribed mortgage officials can help you determine whether a great re-finance is sensible for your requirements and you will direct you towards navigating the procedure. After you will work with us, we will give all of our knowledge and experience into the processes that assist the truth is a finest package. [download_section] When you work at united states, we will offer personalized attention. Regardless if you are trying refinance otherwise obtain yet another mortgage, we can give you the mortgage sort of that is correct to you personally, such:

- Traditional financing: A traditional loan may be the best one for you when the you really have a constant money, a good credit score and you may a down-payment.

- FHA mortgage: If you don’t have big down-payment to help you secure a mortgage loan, discover good news – you’re eligible for a keen FHA loan. Which mortgage kind of would be a stylish replacement conventional investment due to the reduce percentage and flexible borrowing from the bank criteria.

Recent Comments