I am hitched, have a very good credit history, and you can my wife has bad credit. Can i apply for a home loan by myself?

I’ve been married for approximately one year and we also want to invest in a condo, but my spouse have poor credit that may keep you straight back toward good mortgage. My personal borrowing is useful. Must i submit an application for financing by myself, for the purpose of purchasing a home due to the fact a married people? I’d need certainly to use regarding the $250,000. I’m a teacher (15 years).

Usually, for folks who plus spouse make an application for a loan as one, the financial institution will at your joint earnings, mutual financial obligation-to-earnings (dti),and you can all of your credit ratings. If the mate doesn’t have money, or you do not require their particular earnings so you can meet the requirements, then you may make an application for that loan versus him or her.

- stable money – two years or more

- attractive credit rating – a high credit history and you can few mishaps

- lower financial obligation-to-earnings proportion – this new reduced financial obligation you’ve got the most readily useful

- a downpayment – no less than step 3.5%, however, a lot more is most beneficial

When the a potential borrower does not have in any you to definitely (or maybe more) ones, the potential debtor find being qualified for a loan tough.

Run an agent and see exactly what mortgage loans your qualify for. Download a great consistent residential application for the loan (means 1003), over it using only your revenue and borrowing from the bank. Up coming, over another means 1003 which have one another your revenue while the money of one’s partner. In the end, start looking. Score mortgage quotes out of around five pre-processed loan providers of expense.

Reasons to get a joint home loan

Whether your low-credit-get lover makes a leading earnings, there clearly was a chance their unique earnings would replace your dti ratio which means improve odds of getting a loan regardless of the reduced credit rating.

Particular spouses end up being safer inside the property where its label is found on the newest lease otherwise financial. When each other spouses take a mortgage and one mate dies, one other can be guess the borrowed funds and you will depending on how the house is named, the enduring companion gets 100% control of the house without it checking out the probate techniques.

You can find court devices readily available one render a non-signatory mate towards exact same set lawfully. Regarding the loss of the mortgaged mate, this new possession of the home can be handled with a could or believe. Term life insurance can pay the loan if for example the signatory companion becomes deceased.

Reasons why you should not make an application for a mutual home loan

Yet not, for individuals who get a mortgage your self, your entirely carry the responsibility of this home loan obligations. For many who default you by yourself features accountability. this really is a confident otherwise negative based on your position. Let’s imagine your lady rebuilds his or her credit score. Let’s suppose you and your spouse run into unexpected financial challenge, and start to become delinquent into home loan, personal loan companies Ottawa OH or succeed a foreclosure. Your credit rating will take this new slip, while your lady becomes a credit score lifeboat that allows you a couple of to carry on to locate borrowing from the bank.

Otherwise why don’t we imagine an equally dire circumstances in which you and you will your wife plan to divorce. Constantly you to definitely spouse may wish to remain the newest relationship assets. In this case, there is certainly is actually a fifty-fifty opportunity the brand new lover that the house or property within his otherwise their unique title alone could keep the status quo for the mortgage and you can label. If for example the home loan are together stored there is certainly good 100% chance the mortgage will need to be refinanced to remove the fresh non-occupying ex-companion on financial. For these a couple of factors i would recommend that when spouses, lovers, family relations, or members of the family who want to entertain a home to one another normally be able to exercise it put the property in one single individuals title merely.

Testimonial

First, a simple yet effective home mortgage manager will explain tips qualify for a mortgage. an excellent financing manager will help you find the best mortgage for your needs. Visit the debts mortgage deals center to acquire zero-rates prices of to five pre-screened lenders.

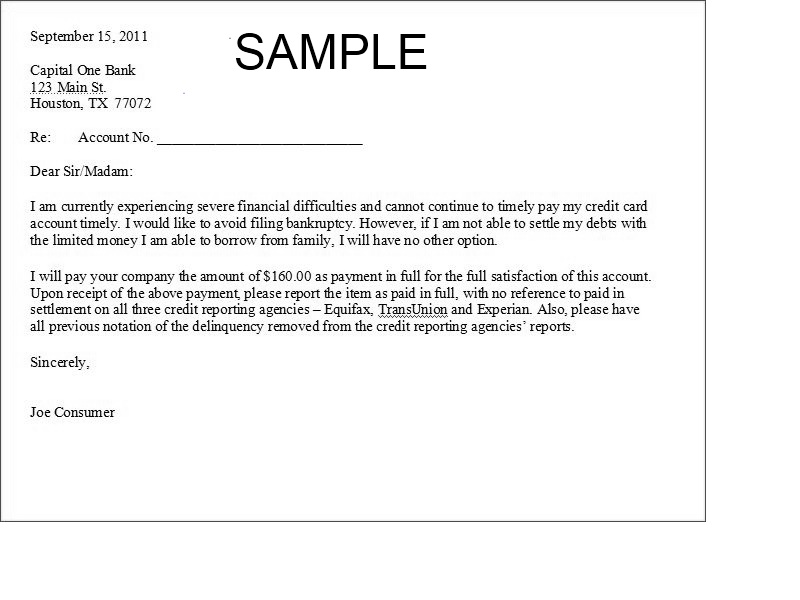

Next, when you have a leading credit history and your companion do perhaps not, dont to provide you to ultimately your partner’s credit cards. Include your wife on the notes because the an authorized representative, which can help remove the credit score right up. the fresh new lover that have bad credit will be pay back any unpaid cards or membership as fast as possible and negotiate a pay for erase to get rid of such unsafe accounts from their credit file.

3rd, it might be important to understand how a credit history try determined. A credit rating is founded on multiple parameters, including:

- commission records (do you have any late money, charge-offs, etc.)

- the quantity and kind away from debt due

- any maxed-aside exchange traces

- multiple additional things in addition to period of credit score as well as how of several latest issues were made with the a credit score.

Settling maxed-aside exchange-traces usually typically raise a credit score. If you like facts, please go to the newest expense credit money page.

Recent Comments