USDA Rural Property are a government supported home loan offered during the New york during the appointed eligible towns and cities. Among great benefits of an effective USDA Outlying Development financial would be the fact it’s got 100% money. As a result accredited buyers should buy property and no downpayment required.

Exactly what precisely try an effective USDA mortgage? It is a government-recognized program built to help reduced- in order to modest -money individuals and you will family members from inside the designated outlying components go homeownership. The application form was applied by U.S. Agency out-of Agriculture (USDA) by way of approved lenders and you may banks and offers reasonable home loan choices to qualified homebuyers.

Vermont USDA Loan Qualifications:

Is qualified to receive a good USDA Rural Property loan, you should satisfy certain home income and you will venue conditions. The yearly domestic money you should never surpass the newest moderate-income restrict for the town, that is dependent on brand new USDA based on family relations proportions and county place. For the majority areas when you look at the Vermont, new USDA Guaranteed earnings constraints begin in the $112,450 having a household of 14 players into the 2024. This income restriction is also higher to own huge families having 5+ members in the family. Charlotte and Raleigh MSA earnings limitations try even greater. Excite see the done chart below.

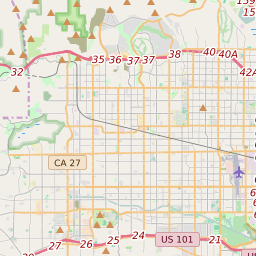

At exactly the same time, the house or property you want to to acquire must be based in a qualified rural city since the laid out because of the USDA. But do not allow name rural deceive your. Of several residential district and you will areas away from towns for example Charlotte, Raleigh, Greensboro, Winston-Salem, Durham have recognized elements. In fact, nearly 97% of the Us remains qualified.

Vermont USDA Mortgage Masters:

- One of the main benefits associated with a good USDA home loan is the power to money 100% of house’s price with no downpayment expected. This can build homeownership far more possible in the event you will most likely not have the funds having a big down-payment.

- Yet another work with is the low-fixed rates of interest provided by USDA money. Such cost are often lower than old-fashioned financing, causing them to an appealing option for funds-aware individuals. Concurrently, there is shorter month-to-month mortgage insurance policies when comparing to FHA financing.

- USDA are not simply for just first-go out home buyers. Anybody can apply for an effective USDA mortgage as long as they meet the earnings and you can borrowing requirements.

- USDA finance don’t possess place financing limits, consumers meet the requirements centered on their loans-to-earnings rates.

- USDA financing has versatile borrowing assistance. Individuals that have smaller-than-primary borrowing might still be able to qualify for a USDA loan, making it a choice for those people who are focusing on reconstructing the credit.

- USDA money supply competitive settlement costs and you may costs. The fresh new USDA pledges these types of financing because of approved loan providers, which will surely help individuals safe way more good conditions and terms.

- And additionally such experts, there are specific advantages of home owners inside Vermont. It county has some rural areas which can be entitled to USDA financing, enabling citizens to take benefit of the new program’s masters.

USDA Loan Restrictions:

- There are important aspects to keep in mind whenever considering good USDA home loan into the New york. First of all, this mortgage program is only readily available for number one homes, perhaps not financing properties or second home.

- There are credit history and you may obligations-to-money ratio requirements that have to be found in order to meet the requirements to have good USDA home loan. However, this type of standards may be alot more lenient as compared to other customary loans.

- USDA mortgages have geographical restrictions as stated above as they are available for only qualified locations. This means that the home becoming bought must be located in a designated eligible urban area according to the USDA map here. *Mention, the latest chart link is a wonderful tool and you may lets people to seek out personal assets address

The brand new USDA app process is simple and sometimes requires times so you can over. People can also be get the full story otherwise begin of the getting in touch with the quantity more than seven days a week, or perhaps submit the knowledge Demand Mode in this post.

Recent Comments