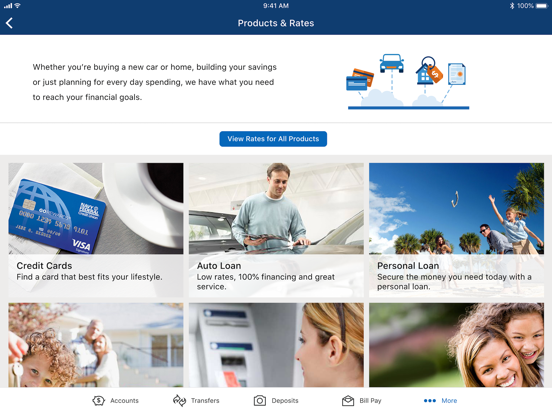

You are making this new Wells Fargo webpages

Youre leaving wellsfargo and you may entering a web site one Wells Fargo does not control. Wells Fargo provides this connect for your convenience, but cannot endorse that’s perhaps not accountable for the merchandise, services, blogs, hyperlinks, privacy, or shelter rules of webpages.

Just before purchase a home, look at the credit history, the debt, along with your offers. People around three items of monetary advice possess a giant perception on your own ability to be eligible for a loan, score a competitive interest, and purchase your house you would like.

Your borrowing from the bank. Your debt. The offers.

While to shop for a house, they are the around three head factors that go on the deciding if you are getting acknowledged to have a home loan, exactly what interest you will be eligible for, or any other very important information one to impact the first home purchase.

Your borrowing from the bank

Your own borrowing from the bank was a measure of how you have addressed funds, playing cards, or any other payments. Your credit history was listed in a credit file, while you are a credit rating feels like a level which is considering according to the guidance from your credit report. Its used by loan providers to test their creditworthiness while the an excellent borrower.

When you’re getting ready to get property, it is advisable to begin with by obtaining a duplicate off your credit history early; watching it does reveal just what lenders come across and help one greatest comprehend the guidance that can help determine your borrowing from the bank score.

A credit file boasts nearly all about their borrowing problem, of which playing cards you have to how much time you have lived at your most recent target. You could order your 100 % free annual duplicate of your credit report off annualcreditreport. It’s also possible to have the ability to order a copy inside 60 days of becoming declined credit or if perhaps your own statement was wrong on account of con, and id theft.

Things your credit report doesn’t come with, however, is your credit rating. Have a tendency to, you can purchase your credit rating free of charge from your own financial. Increased credit history essentially function you are managing your own borrowing well, not credit more you really can afford, and you can spending your entire expenses on time. Increased credit rating will get imply lower interest rates and much more selection toward home financing as the loan providers make use of your credit history so you’re able to let choose whether they agree the application for a financial loan.

The most used credit history try an effective FICO (Fair Isaac Agency) credit history , and that normally ranges out-of 3 hundred to help you 850. The greater your own score, more solutions there will be inside the acquiring a home loan. All the about three significant credit agencies – Equifax , TransUnion , and you can Experian – report your credit rating. Understand that each one of these bureaus uses a somewhat other scoring model, so that your rating can vary a little from just one agency to another.

Whenever a loan provider begins to review your financial wellness as a key part of the financial application, they use a different type of credit file. Its called a good tri-combine credit file plus it combines profile off all of the about three big credit bureau accounts on the one to report. Since report will not merge the credit scores regarding per bureau it does list all three. Very mortgage brokers make use of the middle score having financing in place of an excellent co-borrower and/or down of the two center score in the event the around is an effective co-borrower.

Various other loan providers possess various other guidance, definition your credit score you will be considered you for a financial loan at the that financial but not a separate. Please remember that credit history is one of many activities – such as your income, monthly financial obligation payments, and you will credit rating – that will determine loan-acceptance behavior. For these factors, there isn’t a predetermined score you to definitely assures you’ll get home financing.

Your debt

After you submit an application for a home loan, lenders will appear at the loans to aid determine whether you have enough money for undertake a different sort of fee. They normally use a calculation entitled loans-to-money proportion (DTI).

Personal debt isn’t necessarily a negative toward an application, so long as their total loans cannot go beyond a specific percentage of one’s income. With an obligations-to-income proportion off thirty-five% or quicker is a good principle.

As well, with zero debt no handmade cards might actually reduce your credit score as you aren’t building a history of good credit habits.

not, it’s important to know that making higher requests having fund or playing cards, otherwise beginning a different credit card account prior to making an application for a home loan, may impact your capability so you’re able to be considered – so consider your needs and concerns meticulously.

The offers

If you are considering buying a home, you’ll want to provides cash on hands to fund expenses, together with advance payment and you may closing costs.

You will additionally have to pay towards will set you back related to closure the latest marketing on the home, which include origination fees having home financing, legal expenditures, a property inspection, and a lot more.

Really loan providers need to know you may have sufficient cash in offers to fund several months regarding home loan, tax, and you will insurance costs toward a home – including money to fund your own monthly homeloan payment.

Lenders are required to guarantee the reason of your Olathe cash advance up to $500 own closure and you will down-fee loans, and if a portion of the advance payment are a monetary current out-of a close relative, buddy, boss, or nonprofit team.

Insights your credit score and credit rating

Your credit score and you will credit history will get impact what forms of finance you will be provided, together with interest and you can loan amount.

Recent Comments