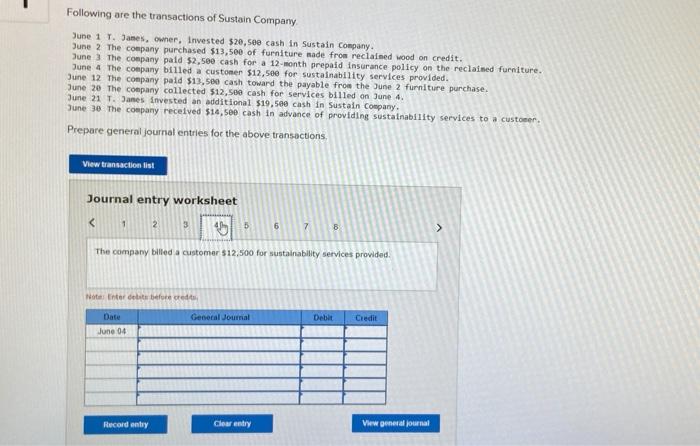

- Earnings facts for example a lender declaration, income tax return, otherwise a cover stub

- Home loan comments, if you have an additional mortgage, needed this as well

If they’re perhaps not, you can research rates until you pick a loan provider that’s recognized. It is possible to get in touch with HARP lender really to own sometimes Freddie Mac or Frannie Mae.

After you have discover a good HARP recognized lender, you can start the program processes. This can be done on your own lender’s place of work or on the internet. It works identical to a traditional mortgage application do, and this refers to where needed all your valuable qualifications and you will income proof.

Once you complete the HARP software processes, the financial institution will along side software. They get in touch with your whenever they you would like one thing next so you’re able to processes brand new app. Which whole process should need as much as 30 days to do, along with your financial usually show you by this entire process.

HARP Upfront Will set you back and you will Closing Schedules

In lieu of many other mortgages, never pay a lot of initial costs with an excellent HARP refinancing system. The specific quantity of the new initial costs differs from bank in order to bank along with your disease. It’s also possible to have to pay getting a credit card applicatoin fee, settlement costs, settlement costs and you may home appraisal.

When you are thinking about refinancing underneath the HARP system, you may be running out of big date. With the closing time for this refinancing program are expanded to help you . You don’t want to hold back until the past second to begin with this step in the event you come across dilemmas otherwise waits.

Average Coupons having HARP Refinancing

Since the real quantity of coupons some body knowledgeable shortly after refinancing the home varies, we are able to mediocre them. Approximately an average of, refinancing your property mortgage which have HARP stored approximately $174 30 days, and that quantity so you can $2,088 annually. When you think more than 3.4 billion someone averaging more $dos,000 a year during the coupons, which is a staggering matter.

HARP Recognized Lenders

While it’s true that of several loan providers was recognized for HARP refinancing, you may need to check around if you don’t choose one one is good for the disease and needs.

- Lender personal loans Miami Texas Shared – Which lender even offers HARP refinancing as they are currently accepting the fresh HARP candidates. You can check out their website or label (800) 261-6888 first off the fresh refinancing processes.

- Chase Lender – You can get your own financial refinanced through the HARP program that have Chase Bank. You can either visit their website or label (866) 550-5705 to begin with the application form process.

- Quicken Financing – That it financial also provides HARP refinancing to the fresh and you will latest people. You can ask for refinancing your financial by going to the website otherwise contacting (800) 971-1622.

- Wells Fargo – Wells Fargo is just one of the larger loan providers which allow it to be HARP refinancing. You can check out them during the the website you can also telephone call (866) 898-1122 to find out more advice.

Benefits of this new HARP Refinancing Program

Choosing to re-finance you reside a giant action, and you’ll really think towards benefits and drawbacks regarding doing this. The HARP refinancing system has of many positive factors to have property owners seeking to re-finance.

Lower Monthly payments: Among the first factors many residents desire to use HARP to re-finance is actually for the lower monthly premiums. Your own monthly payment is dependent on their prior percentage records plus credit score. For those who have a higher credit rating and you can a beneficial borrowing from the bank background, you might qualify for expert fee terminology and lower numbers.

Most readily useful Home loan Terminology: Once again, it all depends on your own credit score and your commission background, you you may be eligible for lower rates over the life of your own mortgage. You can aquire 100 % free refinancing and lower rates once you re-finance. This has the potential to store your a great amount of currency.

Recent Comments