As revenue continues to decline, the owner decides to cut back on the store’s inventory to reduce costs. However, this leads to decreased foot traffic and sales, further exacerbating the problem. To make matters worse, the owner cannot negotiate lower rent payments with the landlord, making fixed costs a significant burden on the business. A third reason companies enter into a death spiral is a lack of financial discipline.

Accounting Term: What Is the Death Spiral?

Companies must know the warning signs of a death spiral and take action early to avoid it. With careful planning and focusing on financial stability, companies can thrive and avoid the pitfalls of a death spiral. A budget is essential for managing your finances and avoiding a death spiral. A budget helps you to plan your expenses and allocate your resources effectively.

What Is a Death Spiral in Business?

The company may be taking on too much risk, restructuring its debt, or finding new revenue sources to pay off its obligations. The further you stray from what you have done in the past, the more skeptical you should be of your costing system’s estimates. Truly new parts should be accompanied by a variety of one-time costs and/or a realistic ramp-up period where costs are calculated assuming less than full efficiency. This drop in price may cause more bondholders to convert because the lower share price means that they will receive more shares.

Understanding Death Spiral Debt

- He has spent more than 25 years working with clients on operational excellence, delivering impactful results that cross industries, corporate cultures, and geographies.

- Furthermore, traders short the stock in the expectation that the stock price will continue to dive.

- Additionally, the pandemic has devastated this industry, causing many businesses to go bankrupt.

- If a company cannot adapt to changing market conditions, it can quickly fall behind its competitors.

- If a company’s market share is consistently declining, it is a sign that it is losing ground to competitors.

Assume that a company manufactures a wide variety of products that require multiple, complicated processes involving expensive equipment. It also manufacturers Products X & Y, which are much higher volume products using a simple process involving inexpensive machines. If the company allocates its fixed manufacturing overhead costs to products based on volume (such as production machine hours), Products X & Y will appear to have high overhead costs. With the Products X & Y no longer being manufactured, the company’s manufacturing production machine hours will decrease significantly. If management again reacts to the new, higher, allocated costs by seeking price increases and loses sales, the company’s manufacturing volume will decrease further.

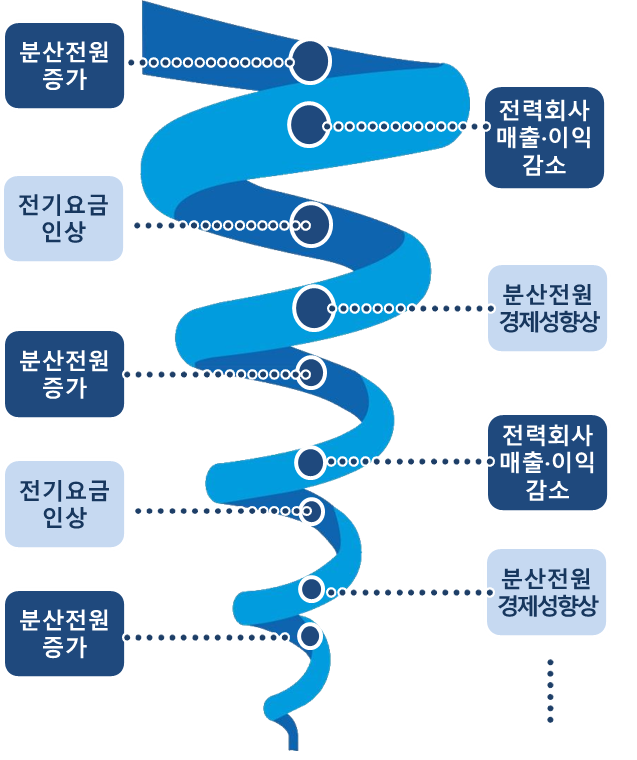

It chooses to eliminate the entire range of products or services instead of identifying and battling the root causes resulting in such troubles. In such situations a series of events lead to a decline of the business and its financial position which becomes difficult to stop of irreversible. One negative situation leads to another, ultimately leading to a spiral of downward movement. The death spiral or the downward demand spiral occurs when an entity finds itself in a series of troubles.

With fewer unit sales and no reduction in overhead costs, the remaining products will be assigned greater per unit overhead costs. If selling prices are increased to cover these still higher unit costs, there could be a further decline in sales. Investing in technology and automation can also play a significant role in mitigating the death spiral. Advanced analytics and machine learning tools can provide deeper insights into cost structures, customer behavior, and market trends.

Financial management is a critical aspect of any business, and one of the most perilous pitfalls it can encounter is death spiral accounting. This phenomenon can lead to devastating financial consequences if not properly managed. Each additional conversion will cause more price drops as the supply of shares increases, causing the process to repeat itself as the stock’s price spirals downward. A company that issues this type of convertible bond is probably desperate for cash to stay afloat. Even employees not directly affected by job loss or reduced benefits may still be impacted by a death spiral. A sense of uncertainty and instability within the company can make it difficult for employees to feel satisfied with their jobs, leading to increased turnover and difficulty attracting new talent.

If a company fails to anticipate potential risks, it can quickly find itself in trouble when things don’t go as planned. If a company’s expenses are consistently rising, it is a sign that it is not managing its finances effectively. The company may be spending more than it earns, taking on too much debt, or failing to manage its expenses. The store has been in death spiral accounting business for several years and has a loyal customer base, but it has been struggling to compete with larger retailers and online marketplaces. Despite declining revenue and profitability, the store’s owner has been reluctant to change the business model significantly. This blog post will explore a death spiral, why it happens, and how companies can avoid it.

If this second case happens and repeats itself multiple times, your client has entered the accounting death spiral. The death spiral refers to a wrong decision that leads to another wrong decision. Often, the wrong decision relates to how costs are spread across the company.

One key benefit of pursuing this latter pricing mechanism is that the price of low sales is separated from the cost of production. By doing so, the overhead now has to be spread over the four remaining products. However, it’s now receiving 25% of the total overhead costs, which might also make it look unprofitable. If your client decides to cut the cord and end Product D’s life, it has entered a death spiral as the increasing burden continually impacts the other product lines. Sometimes, such cases of death spiral financing lead to drastic falls in stock prices, reducing its market capitalization, and resulting in competitors taking over the market.

Recent Comments