Dealers seeking to influence its capital portfolio must ensure it approach meets their overall financial goals, and you can endurance for exposure.

Express

Credit money today to purchase the long term try a method of many profitable investors have used to arrive their personal and you may economic specifications – whether it is purchasing property, spending money on a studies otherwise doing a corporate.

A less frequent, however, similarly give-appearing technique for some, is actually borrowing from the bank to create a good investment profile including brings, securities and you can financial support financing.

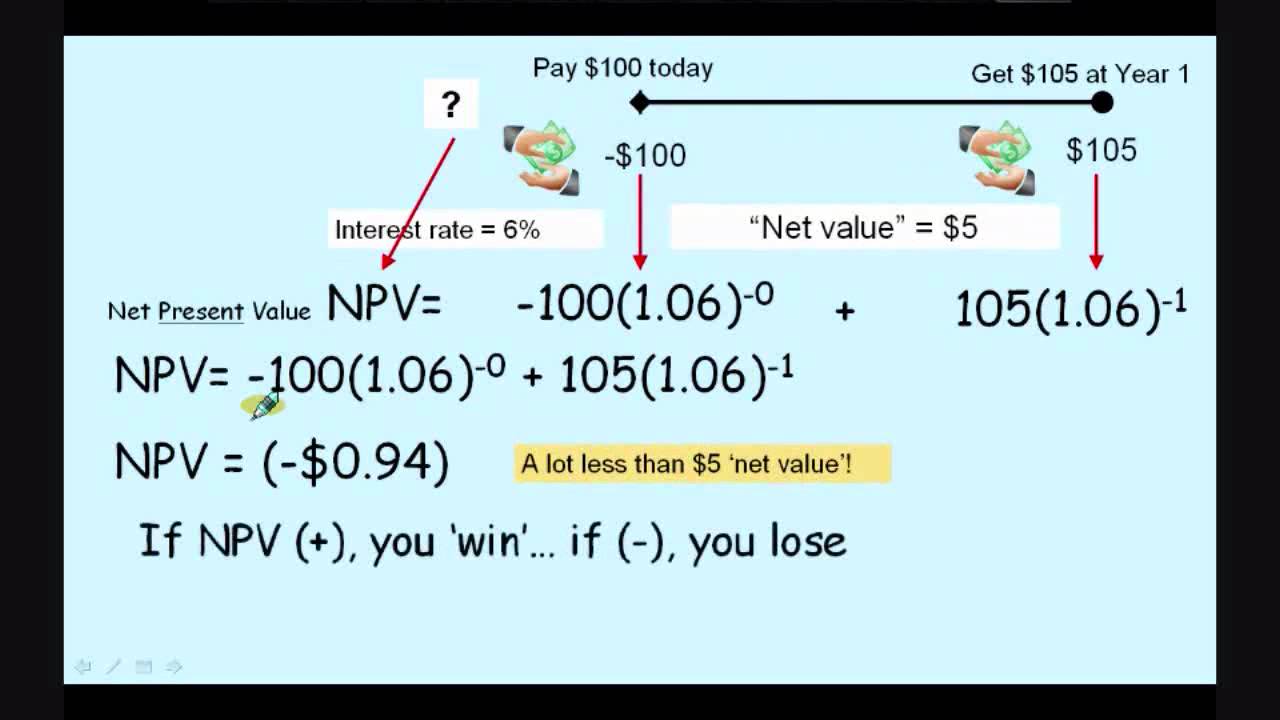

Trying out debt so you’re able to safer investments may seem counterintuitive for some however the potential output tends to be worthwhile when the done strategically, says Tony Maiorino, lead of one’s RBC Family members Place of work Qualities team.

Borrowing is an activity individuals perform each and every day – to have an automible, property or a holiday property, states Maiorino. Practical question was, should you obtain to spend profit the new locations? The solution to you to definitely question is a lot more state-of-the-art.

Credit to spend form you could potentially deploy considerable amounts from financing sometimes in one go or higher a time. The attention, for those investing publicly-traded bonds, may also be tax deductible. You to risk are a good investment made from borrowed currency will get drop for the well worth, which could be a reduced amount of a problem in case it is an extended-title circulate. Concurrently, the expense of the borrowed funds over the years could become greater than the new cash produced from it.

Maiorino says people seeking influence its financial support portfolio need to guarantee this tactic suits their complete monetary requires, and you can tolerance to have chance.

Carried out in a beneficial diversified and you will careful method, credit to blow is as valuable because investing in a beneficial home along the long haul, according to him. For me, it’s about anyone and you may making sure the techniques is right issue in their mind.

Predicated on a study used from the Economist Cleverness Device (EIU), commissioned by RBC Wide range Administration, 53 per cent away from buyers during the Canada state expanding its wealth is actually a top capital means.

The wide range rising questionnaire goals higher-net-worthy of anybody (HNWIs), mature people out of HNWIs, and you may high-making advantages round the Canada, the latest U.S., United kingdom, China, Hong-kong, Singapore and Taiwan. It appears to be during the progressing surroundings out of globally wealth, where riches will be, just what it would be purchased, the way it could well be invested and that is expenses.

Within the Canada, 31 % away from more youthful generations* say they acquire to pay, having 44 percent preferring stocks and 49 % preferring shared financing.

Performing early to construct wealth

Borrowing to blow may start even before individuals has established right up a sizeable money collection, Maiorino states. Including, a trader inside their twenties and you will 30s you will thought borrowing from the bank to help you donate to an authorized later years offers package (RRSP) from year to year. loans Gordon Deductible RRSP efforts can be used to treat individual tax.

People are able to use their tax refund to repay a share of your own mortgage and, ideally, try to pay others later in the year, Maiorino states. The method can then become repeated to build wide range.

When you can afford it, and certainly will make repayments, it is a zero-brainer, says Maiorino, just who used this tactic earlier within his community to develop his very own financing collection.

The one thing you simply cannot go back are time, Maiorino says. If you initiate senior years offers in the 25, once you might be thirty-five, you will have ten years out of investment, and one accumulated progress. Which is some thing an individual who begins expenses during the years thirty-five try never going to has.

Borrowing from the bank to enhance your own riches

Shortly after a trader features a sizeable investment portfolio, they could want to borrow secured on it to help you help grow its wealth. Ann Bowman, direct out of Canadian Personal Financial from the RBC Riches Management, states this is exactly an option top-suited to traders at ease with chance, as well as a conviction they could generate increased come back as compared to cost of the loan.

Recent Comments